Ahmad Khan

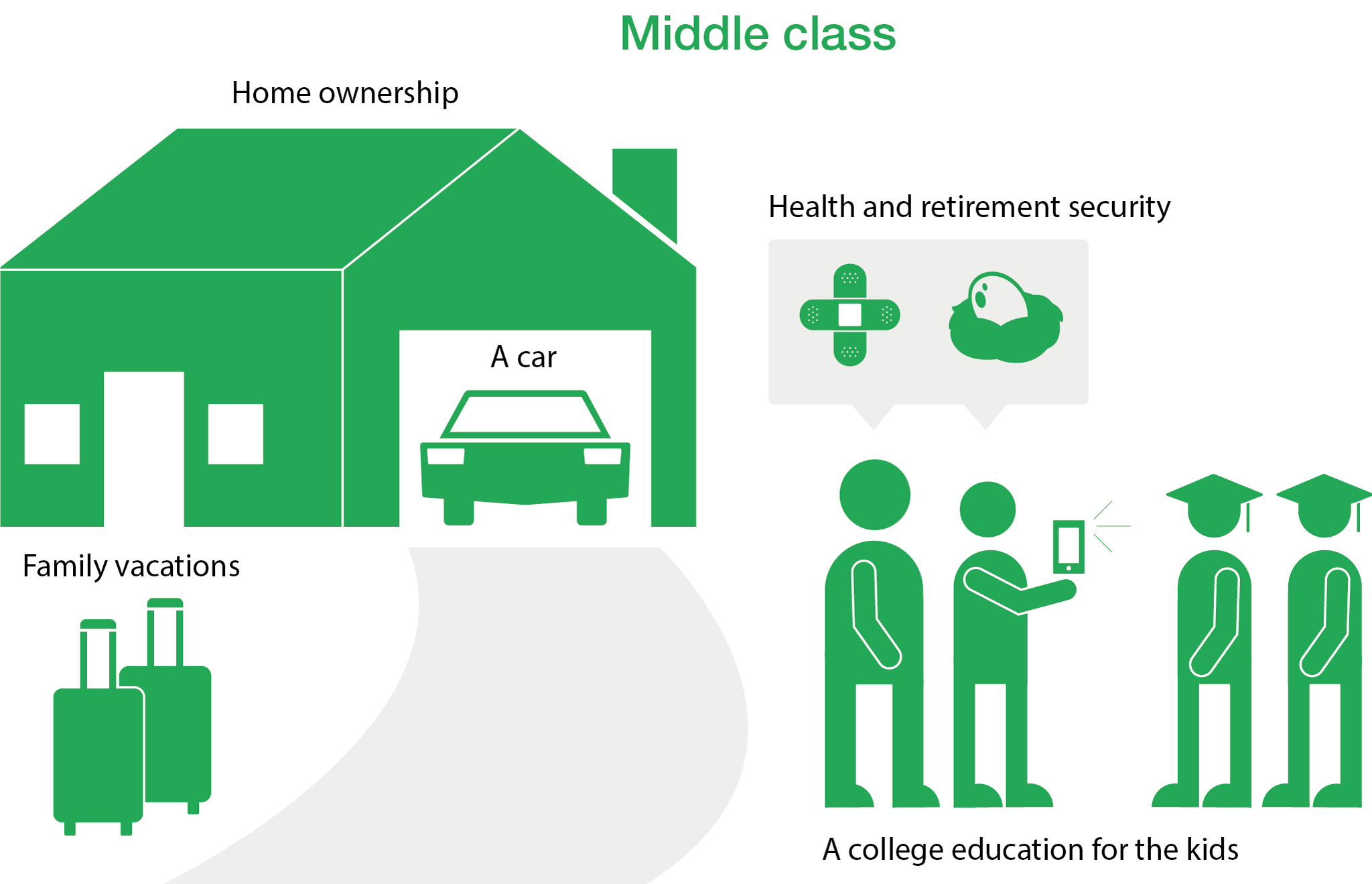

The budget is important for the middle class population for several reasons. First and foremost, the budget directly impacts the financial well-being of the middle class through taxation policies, subsidies, and social welfare programs. It determines the tax rates that the middle class will have to pay, as well as any potential exemptions or deductions that may apply to them.

Additionally, the budget affects the availability and affordability of essential services such as healthcare, education, and infrastructure, which are crucial for the middle class. Investments in these areas can have a direct impact on the quality of life for middle-class individuals and their families.

Furthermore, the budget can influence employment opportunities and economic growth, which in turn affect the middle class. Policies related to job creation, small business support, and industry incentives can directly impact the livelihoods of middle-class workers and entrepreneurs.

Overall, the budget plays a significant role in shaping the economic and social environment that the middle class navigates. Therefore, it is important for the middle class to closely monitor and assess how budgetary decisions will impact their financial stability, access to resources, and overall well-being.

The recent passage of the FY25 budget has sparked a mix of hope and apprehension. It holds the potential to secure the next IMF program, unlocking significant external flows amounting up to $7.5 billion. This potential is a beacon of hope for the future of Pakistan’s economy. However, despite this rare positive note, the budget has been met with criticism for lacking substantial reforms and strategic direction. Some describe it as a “Form 47 budget,” highlighting a discrepancy between the total tax revenue figures and the actual budget measures (Form 45).

A significant point of concern is the disproportionate impact of the budget on urban high income and upper middle-income segments, which face heavy taxation. Furthermore, professionals and small businesses have also been adversely affected, as sales tax exemptions on commonly used products like packaged dairy products have been eliminated. Both salaried and non-salaried individuals bear an increased tax burden, raising questions about the fairness and equity of the budgetary measures.

One of the resounding criticisms is that those without political influence or lobbying power are likely to bear the brunt of increased taxation, creating a scenario wherein formal businesses and their employees, who significantly contribute to the economy, face a disadvantage. On the other hand, multinational corporations and large local businesses, crucial for investment, express frustration with the perceived harsh taxation measures.

The budget’s impact on non-filers is also under scrutiny, with concerns that despite higher withholding rates and punitive measures such as SIM blocking and restricted foreign travel, tax evasion might persist. The removal of sales tax exemptions on essential items like dairy products and medical services, attributed to IMF pressure, has raised further debate about the priorities reflected in the budget.

The failure to reduce income tax for exporters has drawn attention, especially as certain taxation measures appear to disproportionately affect the urban middle class. Specific exemptions for civil and military bureaucrats on property sales, juxtaposed with increased taxation for certain sectors, have further fueled dissatisfaction with the budget’s fairness.

Furthermore, the budget’s focus on protecting certain sectors, while heavily taxing growth and employment-generating sectors, has sparked concern about Pakistan’s skewed fiscal framework. This concern underscores the urgent need for a comprehensive overhaul. Additionally, the involvement and influence of various committees tasked with developing economic policies in shaping the budget remain unclear, raising questions about the extent of expert consultation and local insight in the budgeting process.

Overall, the budget has been criticized for maintaining a “business-as-usual” approach. This approach appears to serve the interests of power centers rather than striving for the transformative change that the country urgently needs. The absence of structural change and the failure to incorporate the undocumented economy into the tax net have deepened concerns about Pakistan’s fiscal outlook and its potential trajectory in the coming years.