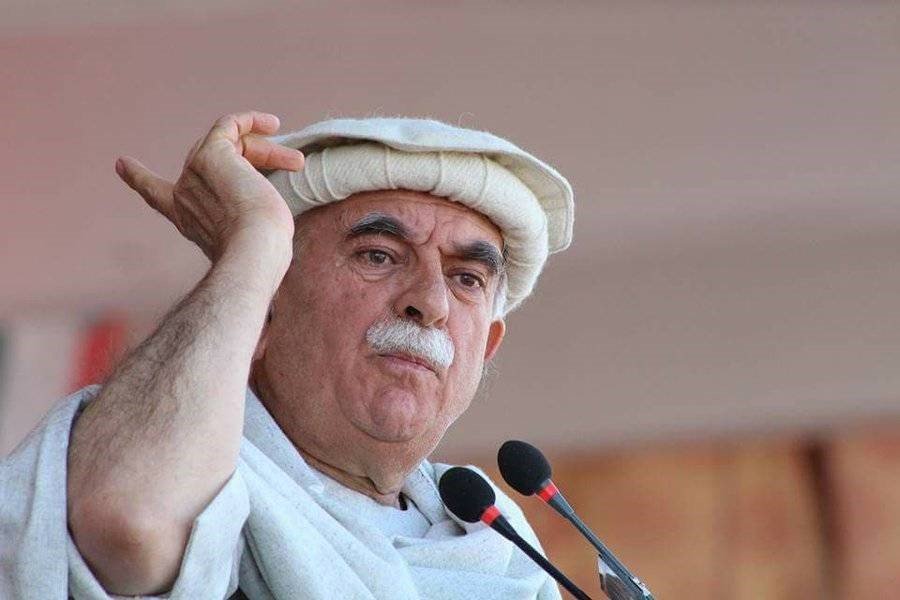

Zafar Iqbal

It has become almost axiomatic that Pakistani products are struggling to compete in international markets, and this un-competitiveness lies at the heart of the country’s stuttering economic growth. The persistent slump in exports has not only stalled industrial expansion but has also drained entrepreneurial confidence and discouraged investors. In this context, the recent call by the Pakistan Business Forum (PBF) for a government-led, long-term policy overhaul is both timely and essential. The forum’s urgent appeal underscores the need for decisive action on a “war footing” to arrest economic decay before it becomes irreparable.

The PBF has highlighted a stark reality: the cost of doing business in Pakistan is approximately 34% higher than in neighbouring and regional states. This disproportionate burden reverberates across industries, start-ups, and entrepreneurs, many of whom struggle to remain afloat amid soaring energy costs, unpredictable taxation, and a volatile exchange rate. The cumulative effect is a commercial ecosystem that is fundamentally fragile, with competitiveness undermined at every stage, from production to export.

At the heart of Pakistan’s economic malaise is policy ad-hocism and a lack of transparency. Without a rational and consistent taxation framework, access to low-interest borrowing, reliable infrastructure, and sufficient raw material supplies, businesses are left navigating a terrain that is not only inhospitable but also unpredictable. Even where industries display resilience, structural obstacles prevent them from achieving economies of scale or expanding into international markets. A sound logistical network, coupled with policy consistency, is the bedrock upon which sustainable industrial competitiveness must rest — a foundation that is largely absent in Pakistan today.

Energy costs compound these challenges. Electricity prices have soared to Rs56 per unit, while imported oil and gas are subject to an unsustainable dollar-rupee parity, inflating production costs to levels that are simply unviable. In such an environment, exporting goods competitively becomes almost impossible. Despite a global recovery in trade across multiple sectors since 2022, Pakistan’s exports have stagnated, reflecting a domestic landscape where high input costs and structural inefficiencies overshadow potential growth.

The severity of the situation is highlighted by the Federation of Pakistan Chambers of Commerce and Industry (FPCCI)’s recent call to declare an “investment emergency.” Foreign direct investment (FDI) inflows are declining sharply, as investors remain hesitant to commit capital in an economy where uncertainty is the norm. Simultaneously, established domestic businesses are signaling retreat, citing a lack of conducive operational conditions, harassment by tax authorities, political instability, and deteriorating law and order. In many cases, these setbacks threaten entire sectors with contraction or closure.

Clearly, a rescue and rehabilitation strategy is indispensable to prevent the domestic industry from sliding toward extinction. Immediate measures must be both pragmatic and structural. An unbiased, investor-friendly taxation policy is critical, ensuring that compliance is straightforward and transparent while providing relief to industries struggling under unsustainable levies. Interest rates must be calibrated to promote industrial borrowing and growth, rather than suffocating capital flows through prohibitive financing costs.

Equally important is the provision of rapid and impartial judicial recourse for commercial disputes. Delayed litigation and lack of enforcement erode investor confidence, discouraging both foreign and domestic investment. Strong legislative mechanisms that guarantee swift resolution can restore faith in the system, signaling to entrepreneurs and international partners that Pakistan is committed to creating a predictable and fair business environment.

Energy policy reform is another urgent requirement. The government must move decisively to bring down energy prices, enabling industries to stabilize operational costs and regain competitiveness. More broadly, the state should function primarily as a regulatory watchdog rather than a market participant, ensuring fair practices, preventing exploitation, and promoting efficiency across critical sectors without stifling private enterprise.

Underlying all these reforms is a need for a long-term, coherent industrial and trade policy. Without a consistent framework, piecemeal interventions will merely serve as temporary relief, failing to address the structural challenges that impede competitiveness. Rationalization of tariffs, simplification of import-export procedures, and targeted support for high-potential sectors are essential components of a sustainable strategy. The government’s role should be one of facilitation and oversight, not arbitrary interference.

Pakistan stands at a critical juncture. The export slowdown is not just an economic indicator; it is a signal of deeper systemic weaknesses**. Without urgent policy intervention, the combined pressures of high costs, regulatory uncertainty, and energy scarcity will continue to undermine industrial growth, discourage investment, and limit the country’s ability to participate effectively in global trade. The time for incremental measures has passed — the need is for decisive, coherent, and long-term action.

If the government heeds the Pakistan Business Forum’s call, it can lay the foundation for a more competitive, resilient, and globally integrated economy. But doing so will require clarity, courage, and the political will to enforce reforms across energy, taxation, finance, and trade. Only then can Pakistan hope to reverse the stagnation, attract investment, and restore faith in its industrial and export potential.