Arshad Mahmood Awan

The economy is expected to grow by 3.2 percent and inflation is projected to drop below 10 percent in FY25, which seems positive. However, many people are worried about expensive electricity bills that could lead to bankruptcy. On top of that, new taxes and rising utility costs could result in many households and small businesses struggling to pay off their debts, which may have long-term effects.

The COVID-19 crisis has hit the poorest people the hardest, pushing many below the poverty line. But it seems like the upcoming economic collapse is caused by our own mistakes, like making bad policy decisions and relying too much on borrowing and lending money. When lending deals failed, it set the stage for a financial crisis that will affect people in all income groups.

While efforts to get financial assistance have temporarily prevented default, the conditions attached to these deals have made it harder to find jobs. Expensive electricity bills have made people very angry, and it looks like there will be high inflation, lots of people out of work, and even more taxes to deal with. Also, promises of lower electricity prices and a new economic plan seem empty and won’t help struggling business owners and buyers.

Upcoming tax hikes and higher energy costs could make things worse for people who are already struggling. As it becomes too expensive to make things locally and sell them to other countries, there will likely be more businesses closing and people losing jobs. The gap between what people earn and what things cost is growing, which could make it even harder for middle-class families to stay financially stable.

This economic situation shows a big difference between the rich, who are protected from high taxes, and the lower and middle-income groups, who are hit the hardest by financial problems. Unfair economic policies are causing serious problems for the poorest people and leading to a deep recession for the middle class. Ignoring the financial struggles of millions of families could tear our society apart and make our economy even worse in the future.

At this difficult time, the government needs to admit that their policies could cause social unrest and make our economy worse. Ignoring the needs of the majority in favor of protecting the rich is dangerous and could ruin our economy and society. If we continue with these unfair economic policies, it could lead to huge problems, so we need to change to more inclusive and sustainable economic policies to avoid a crisis.

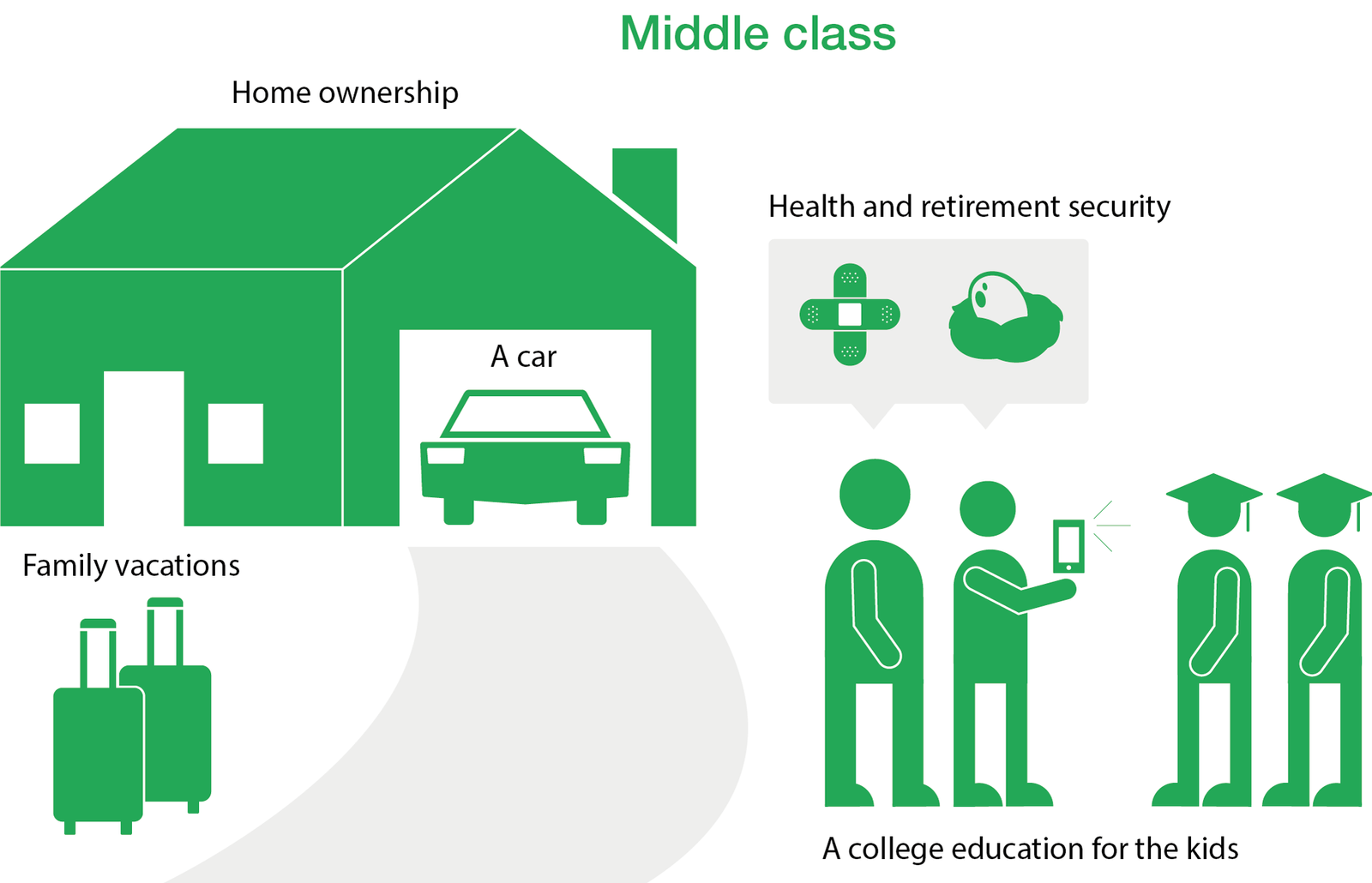

It is important to save the middle class in Pakistan because they play a crucial role in the country’s economy. The middle class forms the backbone of the economy, as they are the ones who drive consumer spending and contribute to economic growth. If the middle class is not financially stable and struggles to cope with rising living costs, it could lead to a decline in consumer spending, which would negatively impact businesses and the overall economy.

Furthermore, a strong and stable middle class is vital for maintaining social stability and harmony. When the middle class is financially secure, it helps to reduce social inequality and prevents social unrest. If the middle class faces financial hardships due to rising living costs, it could lead to increased social tensions and unrest.

Therefore, it is essential to implement policies that protect the interests of the middle class and ensure that they are not disproportionately affected by rising living costs. This may involve measures to control inflation, provide affordable housing, create job opportunities, and increase access to education and healthcare. By safeguarding the middle class, we can promote a more stable and resilient economy and society for everyone.

Pl subscribe to the YouTube channel of republicpolicy.com