The Federal Board of Revenue (FBR) has expressed serious concerns about the widening disparity in tax compliance during the fiscal year 2023-24. A new FBR report reveals a substantial gap between income and sales tax participation, with 4.7 million active taxpayers but only 234,193 sales tax filers.

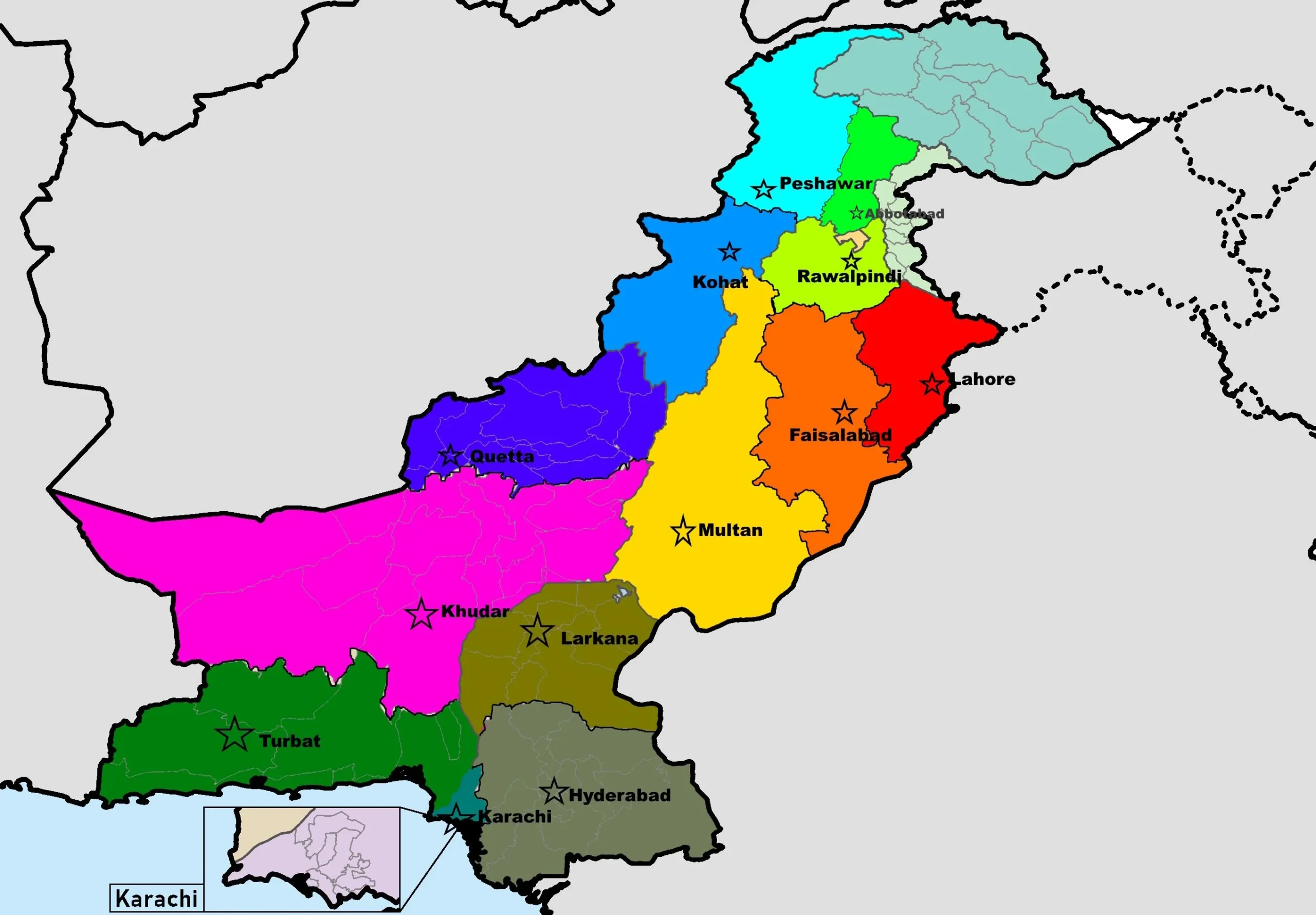

Regional Tax Office (RTO) Lahore stands out, leading both income and sales tax filings. Karachi and Faisalabad also show strong tax compliance, while regions like Multan and Islamabad lag behind, with a focus on specialized taxpayers.

Pl watch the video and subscribe to the YouTube channel of republicpolicy.com

Pakistan continues to face a significant revenue gap of Rs3.4 trillion due to tax evasion, as highlighted by the finance ministry. While urban centers dominate the tax base, regions like Sialkot are performing surprisingly well in terms of tax participation. The data underscores the urgent need for expanding sales tax compliance, especially in areas with high income tax participation.

FBR’s report shows consistent growth in taxpayer engagement, with RTO Lahore leading with 809,131 active income tax filers and 41,783 sales tax filers. Karachi follows closely with 522,284 income tax filers and 20,979 sales tax filers, indicating steady progress in broadening the country’s tax base.