The Federal Board of Revenue (FBR) has announced that late-filers of income tax returns can now be included in the Active Taxpayer List (ATL) after paying a specific surcharge.

In a recent notification (S.R.O.1635(I)/2024), the FBR clarified that individuals who file their returns for the most recent tax year by the original deadline or any extended deadline will have their names added to the ATL.

The term “latest tax year” refers to the last completed tax year before the return is submitted. If a person files after the due date, they can still be added to the ATL if they pay the required surcharge.

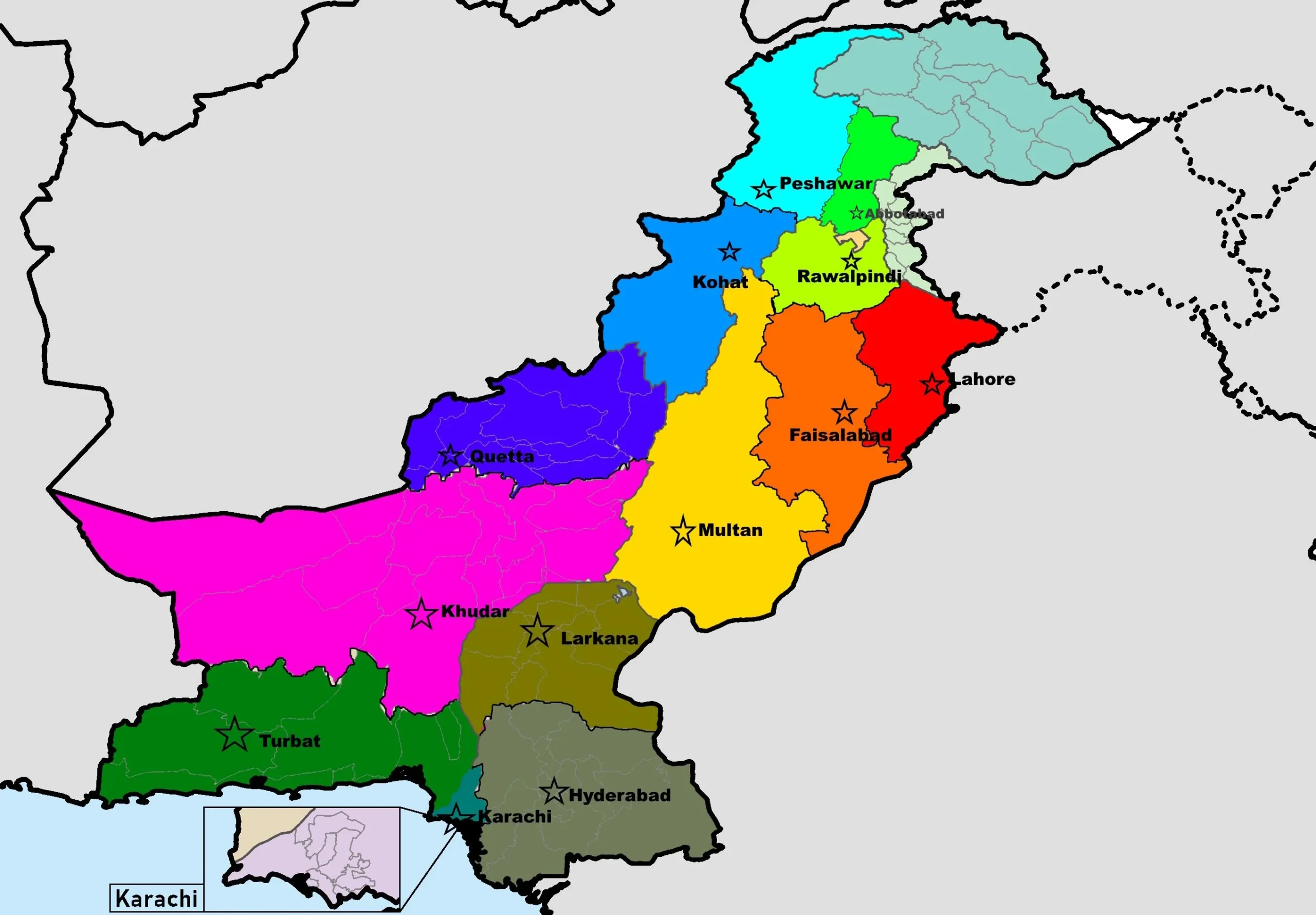

Moreover, companies or associations formed after June 30 of the relevant tax year will also be included in the ATL if they haven’t filed their returns yet. This updated rule also applies to those who file returns with the Azad Jammu and Kashmir Central Board of Revenue or the Gilgit Baltistan Council Board of Revenue.