Editorial

In the first quarter of this year, the federal government has successfully paid off over one trillion rupees of domestic debt that was taken for budget support, largely thanks to strong foreign inflows and record profits from the State Bank of Pakistan (SBP). Here are three key points to consider.

Firstly, the government’s budget for the current fiscal year estimated domestic debt servicing at 8.736 trillion rupees, which is higher than the revised estimate of 7.211 trillion rupees, reflecting a 21 percent increase. This aligns with the same percentage rise in overall budget expenditures. It remains unclear whether the one trillion rupee debt retirement involved matured treasury bonds, which wouldn’t affect servicing costs, or if it was unplanned debt clearance that could potentially ease budgetary pressures.

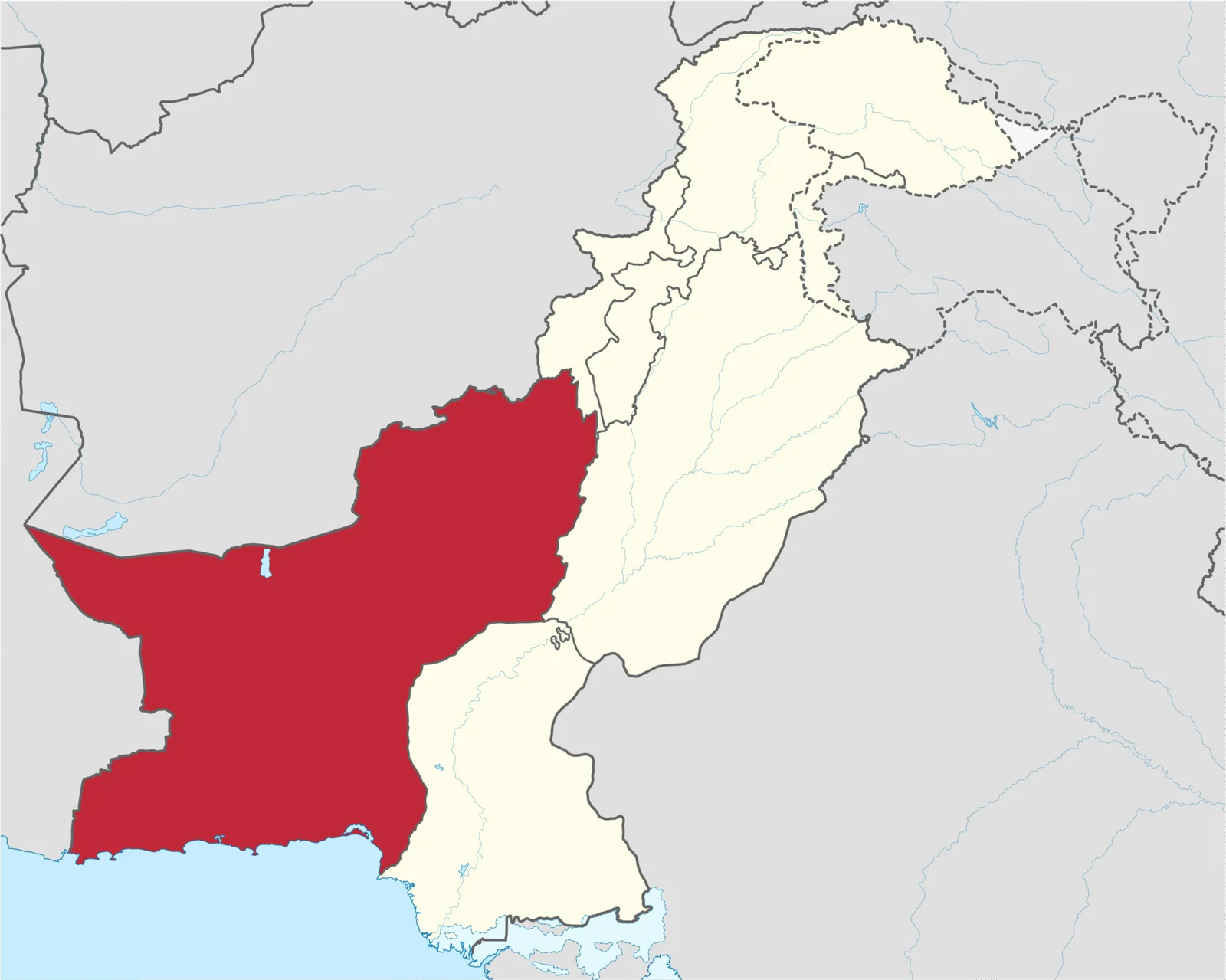

Secondly, while there are claims that the reduction in domestic debt was fueled by robust foreign borrowing, this raises concerns among domestic economists. Much of this foreign funding comes from the International Monetary Fund (IMF) and other international entities, as well as financial support from friendly countries like China, Saudi Arabia, and the UAE. However, foreign debt necessitates repayments in dollars. Despite reported healthy foreign exchange reserves, which cover just over two and a half months of imports (less than the ideal three months), this could lead to challenges when it comes time to meet those obligations.

Lastly, the SBP reported profits of 3.4 trillion rupees for the last fiscal year—up by 200 percent from the previous year—attributed to high interest rates and currency gains. This figure surpasses prior estimates. However, the projected profit for this fiscal year stands at a more optimistic 2.5 trillion rupees, which seems overly ambitious given the current trends and the recent debt repayments from July to early October, which exceeded 765 billion rupees.

While indicators linked to external borrowing have improved since the IMF approved ongoing funding arrangements, the conditions affecting the living standards of the most vulnerable populations remain concerning. For instance, electricity tariffs continue to rise, partly due to a shift towards renewable energy without properly addressing existing contracts with independent power producers. Meanwhile, while food prices have seen a seasonal drop, rents continue to increase.

In summary, although there are positive signs on the economic front, these are overshadowed by a growing reliance on foreign debt, whose servicing needs to be supported by increased foreign exchange earnings from trade and remittances, rather than the escalating levels of borrowing.