Editorial

This significant gap, primarily due to the stay orders imposed by superior courts on various tax measures passed by parliament, should raise immediate and critical concerns about the legal soundness of these measures and their potential impact.

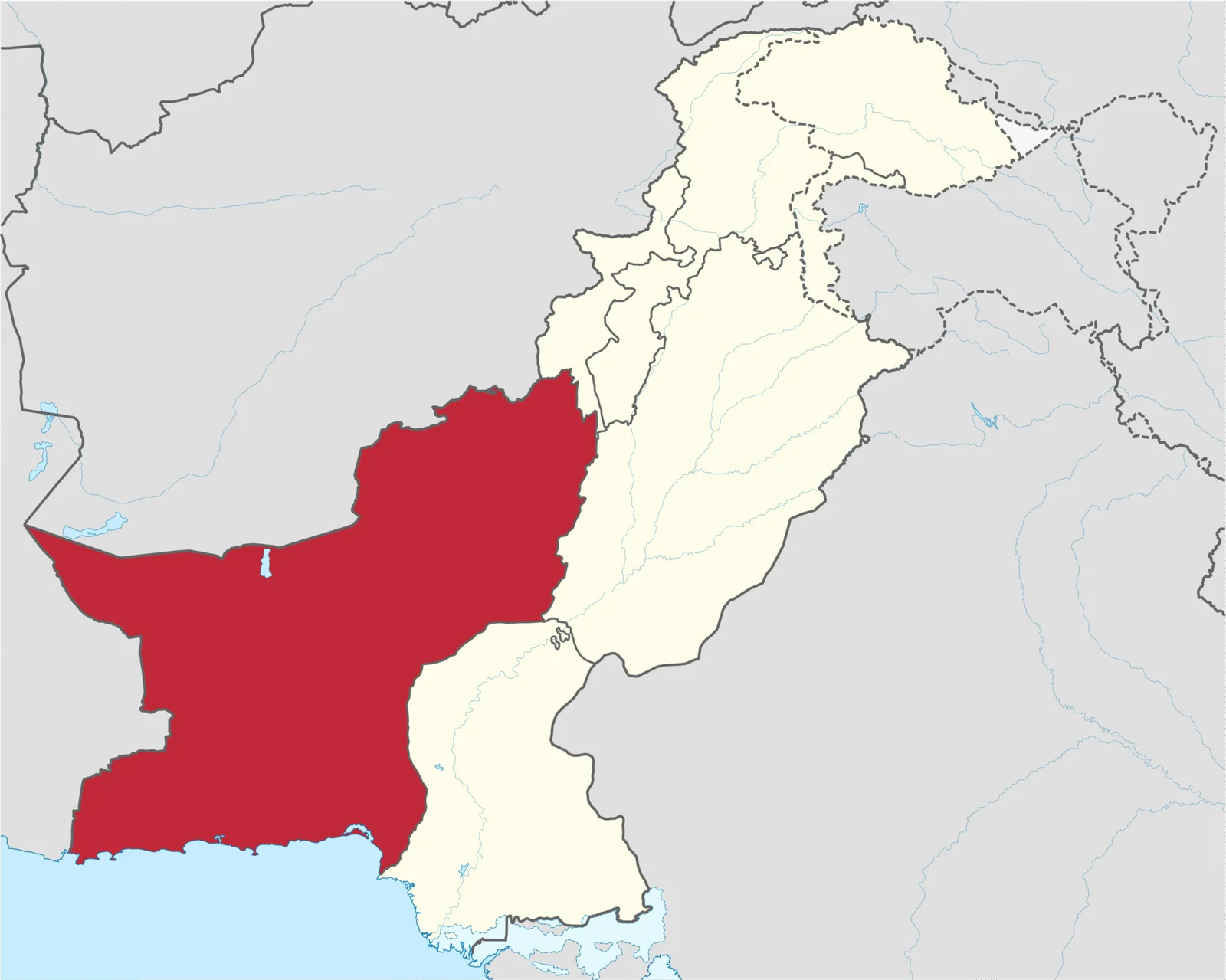

A prominent example of the legal challenges faced by the FBR is Section 7E of the Income Tax Ordinance 2001, which focuses on immovable properties. This section, which was introduced to tax the deemed income from immovable properties, has encountered resistance in multiple courts. Recent verdicts, such as the Balochistan High Court’s declaration of it being ultra vires to the Constitution, underscore substantial legal anomalies within these legislative measures.

Section 7E imposes a 20 percent tax on a deemed income, calculated as five percent of the fair market value of immovable property, regardless of whether the property generates actual income. However, courts have highlighted that deeming mere ownership of property as income for taxation purposes exceeds the government’s constitutional powers.

In addition, the attempt to impose a super tax through Section 4C of the Income Tax Ordinance, initially as a one-time tax at four percent and later revised to a permanent 10 percent tax with retrospective impact, has faced legal opposition. Courts have ruled against the retrospective application of increased tax rates, emphasizing that such measures contradict established legal principles, such as the principle of non-retroactivity in tax law.

While litigants have appealed these court orders, awaiting decisions from the Supreme Court, the significant revenue implications are clear. Depending on the rulings, the government’s revenue collection and the achievement of its tax targets could be significantly impacted, potentially leading to a further increase in the revenue shortfall.

The legal obstacles encountered by these tax measures underscore the systemic flaws in the legislative process. The rushed passage of laws without thorough debate and scrutiny not only undermines the spirit of democracy by limiting public participation and transparency but also poses substantial economic and national implications, as it can lead to the enactment of laws that are not fully vetted for their legal soundness and potential impact.

The current predicament underscores the urgent need for a comprehensive reevaluation of the legislative process. This reevaluation should prioritize the importance of parliamentary debate and scrutiny to identify and rectify inherent flaws in proposed laws. By adopting transparent and robust legislative measures, the government can effectively mitigate legal challenges, uphold constitutional principles, and ensure a more stable and sustainable economic framework.