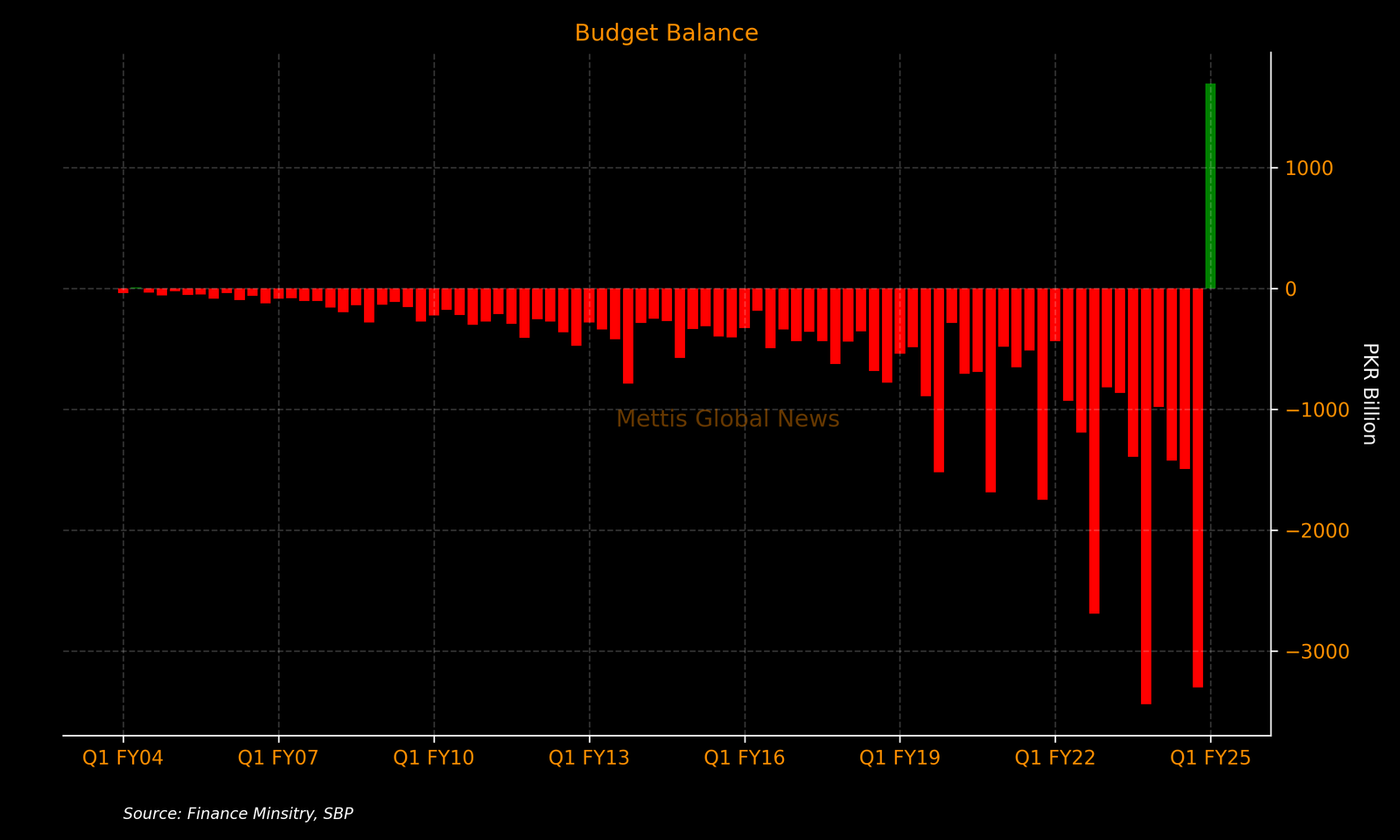

Pakistan has reported its first budget surplus in over 20 years during the first three months of the 2024-25 fiscal year. This success was due to higher revenue and significant profits from the State Bank of Pakistan.

The budget surplus amounted to Rs1.696 trillion, or 1.4% of the GDP, compared to a deficit of Rs980.06 billion, or 0.9% of GDP, during the same period last year.

Additionally, the primary surplus reached Rs3 trillion, or 2.4% of the GDP, up from Rs399.55 billion, or 0.4% of GDP, in the previous year.

During this quarter, the government reduced its domestic debt by Rs1.54 trillion and external debt by Rs156.86 billion.

Total revenue jumped 117%, totaling Rs5.83 trillion compared to Rs2.69 trillion last year. Tax revenue increased by 25.2% to Rs2.78 trillion, while non-tax revenue surged by 550.9% to Rs3.05 trillion. Most of the tax revenue came from direct taxes (Rs1.23 trillion), sales tax (Rs904.76 billion), customs (Rs276.87 billion), and Federal Excise Duties (Rs151.06 billion). The State Bank’s surplus profit contributed Rs2.5 trillion to non-tax revenue, compared to just Rs972.18 billion for the entire previous fiscal year, along with Rs261.69 billion from petroleum levies, rising from Rs222 billion last year.

On the spending side, the government spent Rs4.13 trillion, or 3.3% of GDP, which is a 12.7% increase from the same quarter last year. Approximately 86% of this spending (Rs3.54 trillion) went to current expenses, including interest payments (Rs1.31 trillion), defense (Rs410.17 billion), grants (Rs239.21 billion), and pensions (Rs222.83 billion).

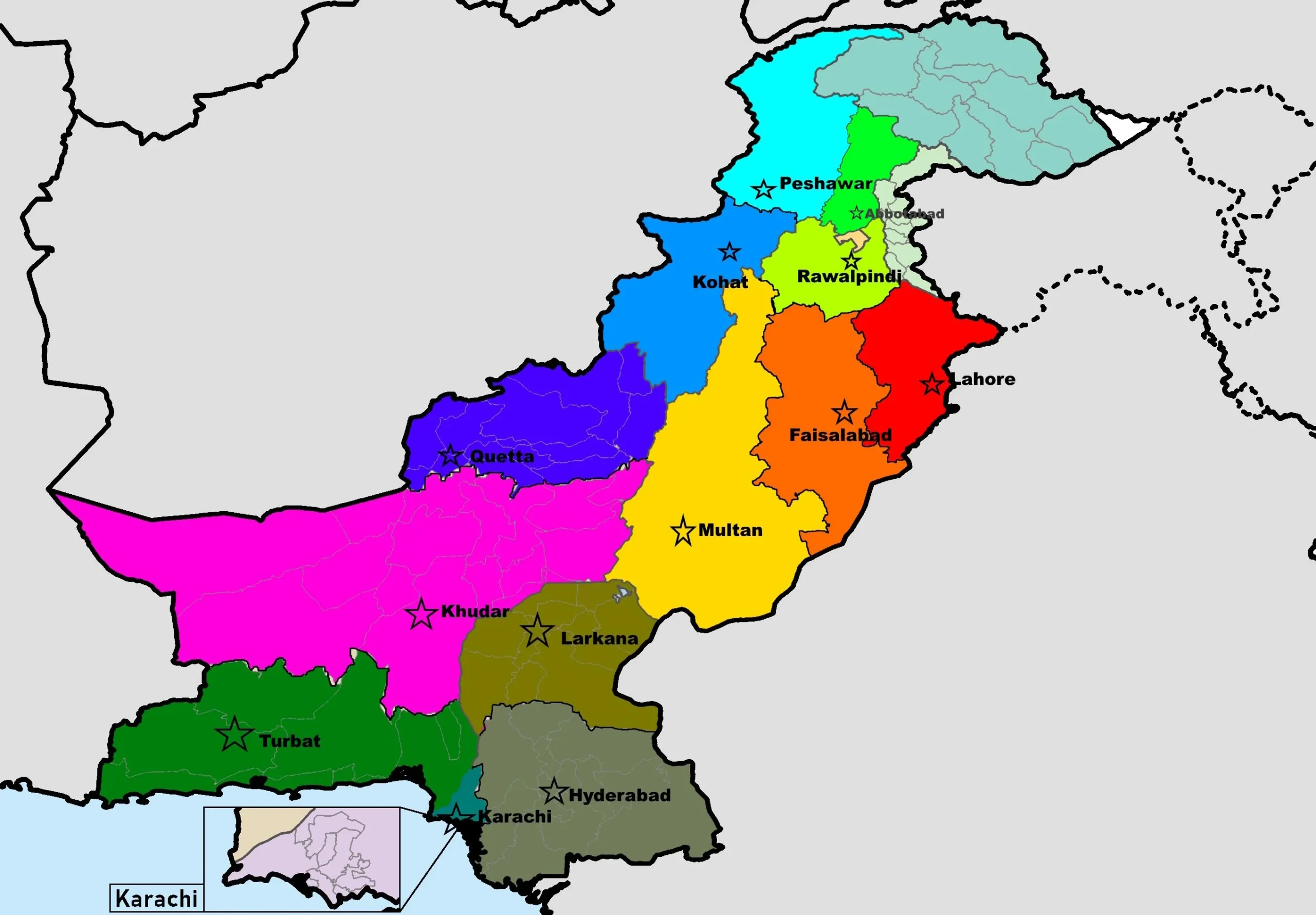

Among provinces, Punjab had a deficit of Rs160.16 billion, while Sindh reported a surplus of Rs131.1 billion, followed by Khyber Pakhtunkhwa with Rs103.75 billion, and Baluchistan with Rs85 billion.