Pakistan has the highest living cost in whole of Asia with 25% inflation rate and its economy may grow at the fourth lowest pace of 1.9% in the region, read a new Asian Development Bank (ADB) report.

Released on Thursday, the Asian Development Outlook also painted a gloomy picture for the next fiscal year as well.

Published from Manila, the report has projected 15% inflation rate for the next fiscal year — again the highest among 46 countries and a 2.8% growth rate — the fifth lowest for FY2024-25.

The ADB stated that the inflation rate in Pakistan is expected to be 25% in the current fiscal year — the highest in whole of Asia. This makes Pakistan the most expensive nation in Asia. Earlier, the cost of living in Pakistan used to be the highest in South Asia.

The State Bank of Pakistan (SBP) and federal government had set the inflation target at 21% for this fiscal year but they are going to miss it despite inflicting huge losses in the shape of a 22% interest rate.

The ADB said during the current fiscal year, the country’s economic growth rate might remain at 1.9% — the fourth lowest after Myanmar, Azerbaijan and Nauru.

Pakistan is in a stagflation phase for a prolonged period and the World Bank too said last week that another 10 million more people might fall into the poverty trap because of any adverse shocks. About 98 million people are already living a poor life in Pakistan.

Despite these gravest conditions, Prime Minister Shehbaz Sharif and Finance Minister Muhammad Aurangzeb have the audacity to approve four salaries in reward for the already highly paid officers of the PM Office.

The total impact of the decision for the officers category will be over Rs50 million — a sum that is enough to buy 34,247 kilogrammes of wheat at market prices. There is also a glaring similarity in the ADB and World Bank reports this time.

In the past, the ADB gave a rather optimistic economic scenario close to Pakistan’s official forecasts.

However, the latest ADB report stated that Pakistan would continue to face challenges from substantial new external financing requirements and the rollover of old debt, exacerbated by tight global monetary conditions.

The Manila-based lender said political uncertainty that affected the macroeconomic policy making would remain a key risk to the sustainability of stabilisation and reform efforts.

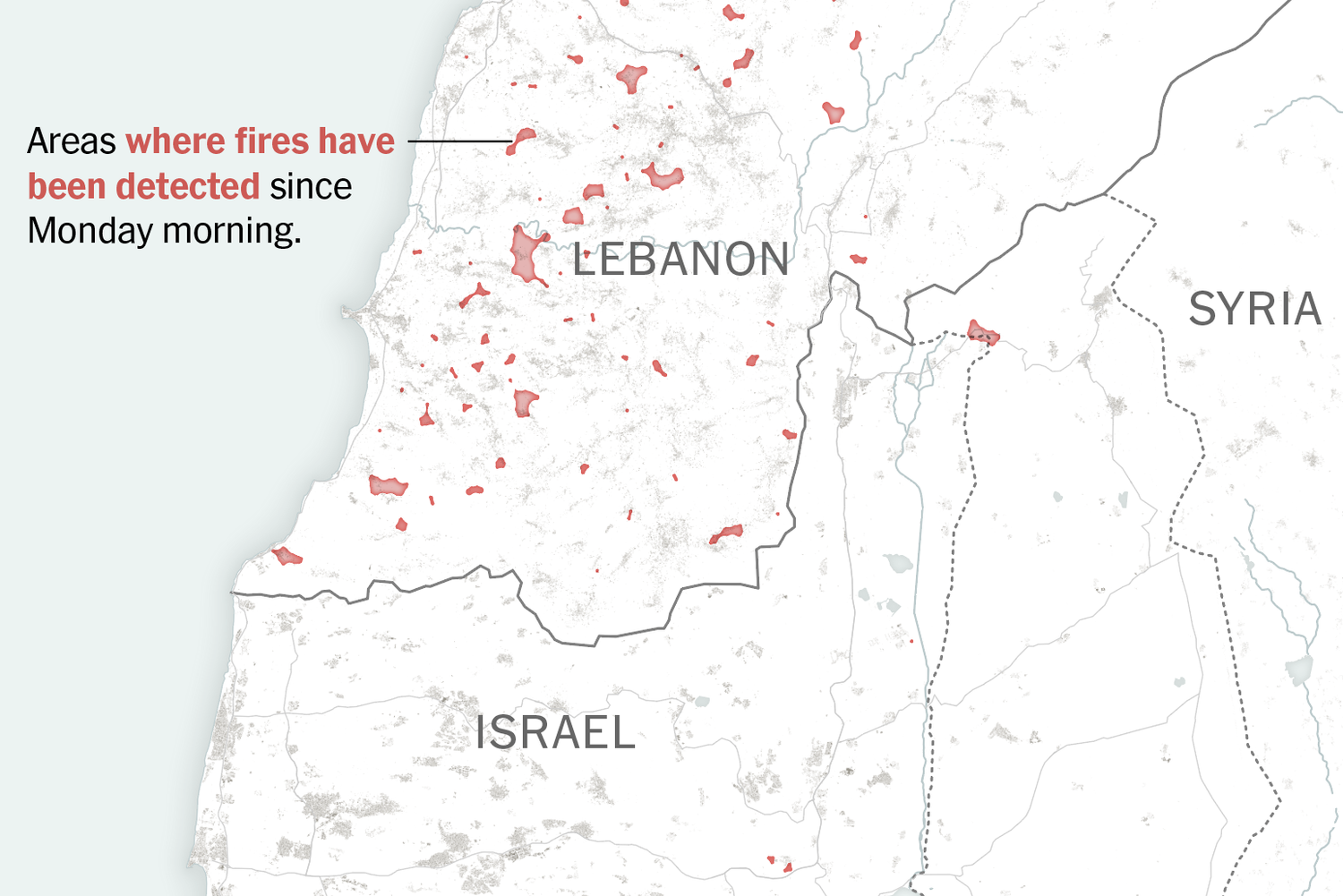

On the external front, the potential supply chain disruptions from escalation of the conflict in the Middle East negatively affect the country’s economy, it added.

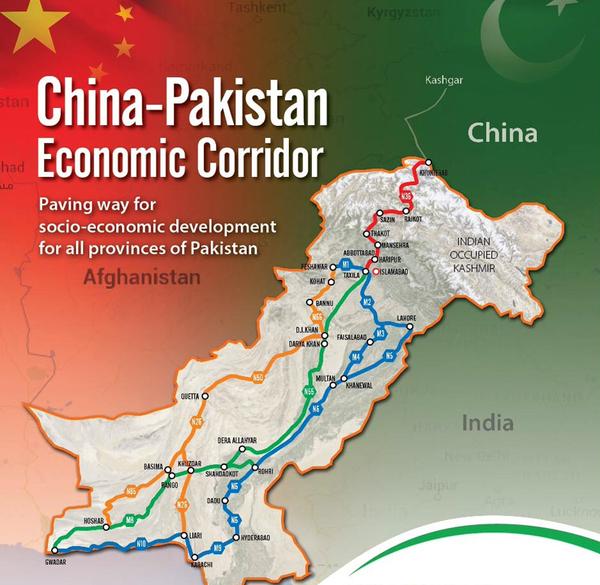

The ADB said with Pakistan’s large external financing requirements and weak external buffers, disbursement from multilateral and bilateral partners remained crucial.

The Manila-based lender cautioned that these inflows could be hampered by lapses in the policy implementation.

“Further IMF support for a medium-term reform agenda would considerably improve market sentiment and catalyse affordable external financing from other sources,” the report added.

Federal Finance Minister Muhammad Aurangzeb is set to meet the IMF Managing Director Kristalina Georgieva next week in Washington to request a new bailout package.