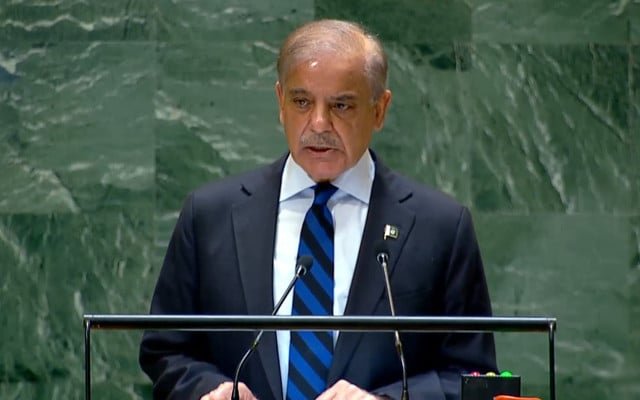

Prime Minister Shehbaz Sharif has reaffirmed his government’s commitment to speeding up key institutional reforms, saying that Pakistan is now moving from economic stability toward growth.

He made these remarks during a meeting in Islamabad with a delegation from the International Monetary Fund (IMF), led by Jihad Azour. The discussion centered on Pakistan’s ongoing IMF-supported economic reform program. Both sides expressed satisfaction with the progress made so far and the positive impact of the reforms.

The IMF delegation also pledged continued support for Pakistan’s efforts to stabilize and grow its economy.

Tensions Over Proposed Tax Hikes on Farmers

However, not everything is smooth sailing. One key point of contention is the IMF’s push for increased taxes on agriculture-related products. According to The News, the IMF has proposed doubling the Federal Excise Duty (FED) on fertilizer from 5% to 10%, and adding a new 5% tax on pesticides — moves that could raise Rs30–40 billion in revenue next year.

But Prime Minister Shehbaz and his economic team are pushing back. They’re trying to convince the IMF not to impose these taxes on farm inputs, especially since an Agriculture Income Tax (AIT) is already set to take effect on July 1, 2025. That tax, expected to be managed at the provincial level, could generate an estimated Rs40–50 billion from farmers once it’s fully operational.

Broader Tax Reform in the Works

The IMF and Pakistani authorities are also exploring broader tax reforms. One idea being discussed is applying the same tax rules to all income sources and introducing a unified registration threshold for both income tax and GST. This move would aim to simplify the tax system and improve compliance across businesses in the upcoming federal budget.

As budget planning intensifies, the government is walking a tightrope between meeting IMF requirements and protecting its key economic sectors — particularly agriculture — from excessive tax burdens.