Editorial

The focus has shifted from identifying the flaws in the privatisation process to questioning if anything at all went right. A mere 12.5 percent of the minimum bid of 80 billion rupees was submitted by the sole bidder, a real estate magnate with no prior experience in the airline industry. His bid of 10 billion rupees raises eyebrows, especially as credible reports suggest he lacked the necessary liquidity and was heard inquiring whether land value could be factored into his offer.

Privatisation Minister Aleem Khan, himself a major player in the real estate market, defended the sale framework established during the caretaker government following the Shehbaz Sharif-led Pakistan Democratic Movement’s proposal on July 26, 2023. This proposal amended the 2017 Election Act, allowing caretakers to take necessary actions for Pakistan’s economic interests. However, this broad authority was opposed by Business Recorder, raising concerns about the potential for abuse.

Khan’s recent criticisms of former Privatisation Commission chairmen reflect poorly on his political integrity, especially considering his prior affiliation with the Pakistan Tehreek-e-Insaf (PTI), where he criticized fellow cabinet members for corruption and incompetence. Given his influence as Chairman of the Commission, one would expect him to take accountability for the bidding debacle—ideally, by resigning, although it’s uncertain whether the Prime Minister would accept such a gesture.

The situation grows more troubling with former Prime Minister Nawaz Sharif’s assertion that his daughter, Maryam Nawaz, is interested in purchasing the airline to rename it Punjab Air while acquiring new aircraft. If she believes the province can afford such an investment, a discussion with the finance secretary is in order. Punjab is already under pressure to meet a 342 billion rupee surplus commitment to the International Monetary Fund, a target it has previously missed.

If the Nawaz family intends to pursue this acquisition, they should consider Richard Branson’s advice on starting an airline, which demands vast resources and comes with substantial risk—evident in the $200 million Branson personally invested to save Virgin Atlantic.

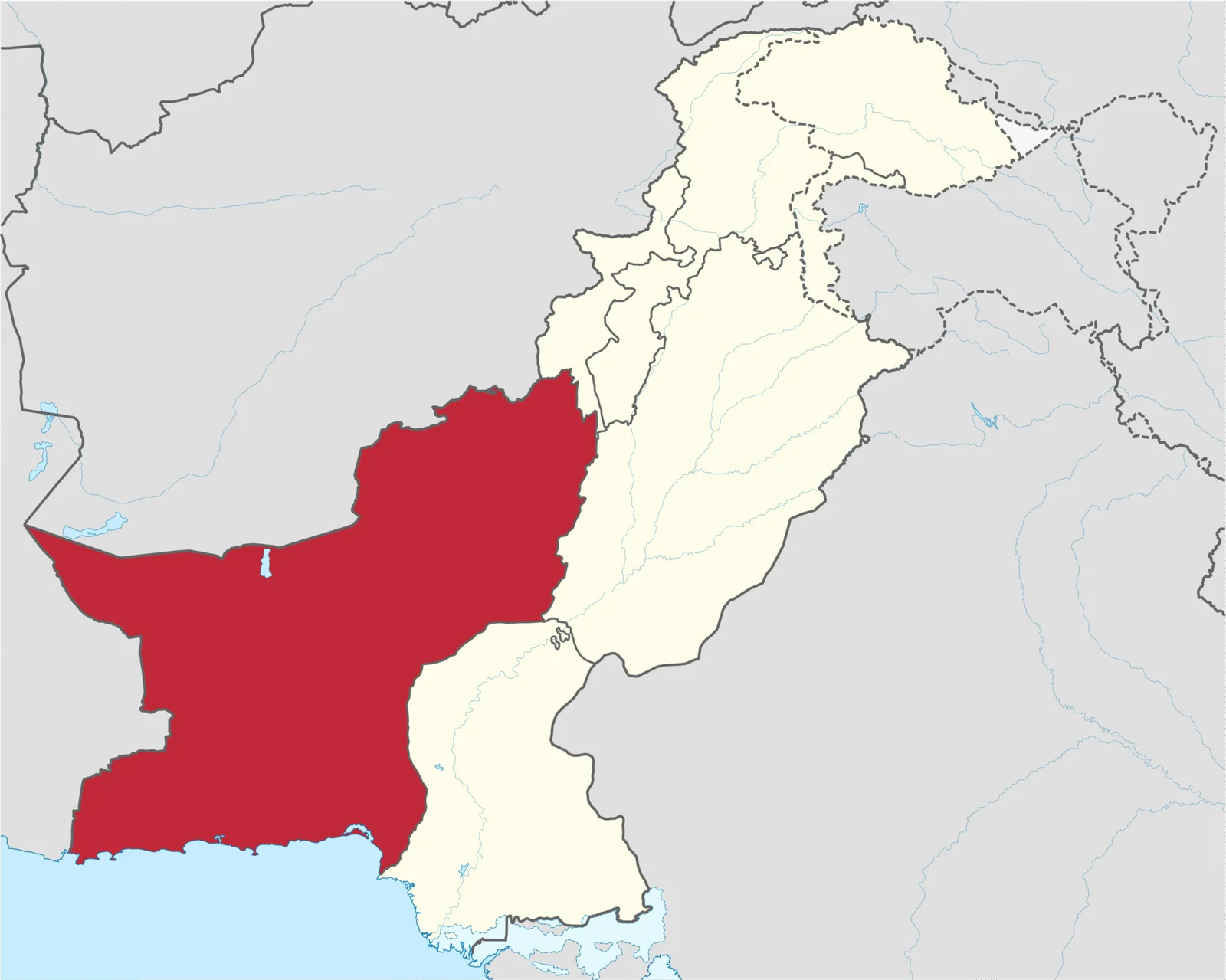

Meanwhile, Khyber Pakhtunkhwa has expressed interest in joining the bidding process to keep the airline within the national framework, despite having even fewer resources than Punjab. It is crucial that both provincial governments prioritize improving physical infrastructure and social services for their citizens instead of pursuing financially burdensome projects.

The challenges facing privatisation extend beyond mere financial limitations; they encompass an uninviting investment climate and a flawed financial framework that leaves both new owners and the public burdened with massive interest payments on pre-existing debts. The public continues to pay tariffs that include interest charges stemming from previous government decisions to mishandle energy debt.

Addressing these substantial issues and fostering accountability for past misguided policies is essential. Only then can Pakistan hope to attract individuals of integrity in both economic and political spheres.