Editorial

The Federal Ministry of Finance has released data on the fiscal operations of provincial governments in the first half of 2024-25, shedding light on their financial performance amid the IMF Program’s growing focus on provincial governance. Historically, provincial governments in Pakistan have struggled with limited revenue generation, with only 7.5% of national revenues attributed to them in 2023-24, despite having substantial fiscal powers, including agricultural income tax and sales tax on services.

One of the key issues highlighted is the low provincial tax-to-GDP ratio, which stood at just 0.7% in 2023-24. This is significantly lower compared to India’s states, which generate almost 6% of their GDP in taxes. Consequently, 83.4% of provincial spending in 2023-24 was financed by federal transfers, underscoring the need for provinces to enhance self-financing for social services.

Pl watch the video and subscribe to the YouTube channel of republicpolicy.com

For the first half of 2024-25, the IMF has set targets for provincial governments, focusing on a combined budget surplus, tax revenues, and spending on health and education, which account for over 90% of provincial expenditures. Notably, the targeted budget surplus and tax revenues were exceeded, with a surplus of Rs 775 billion and Rs 442 billion in tax revenues as of December 2024.

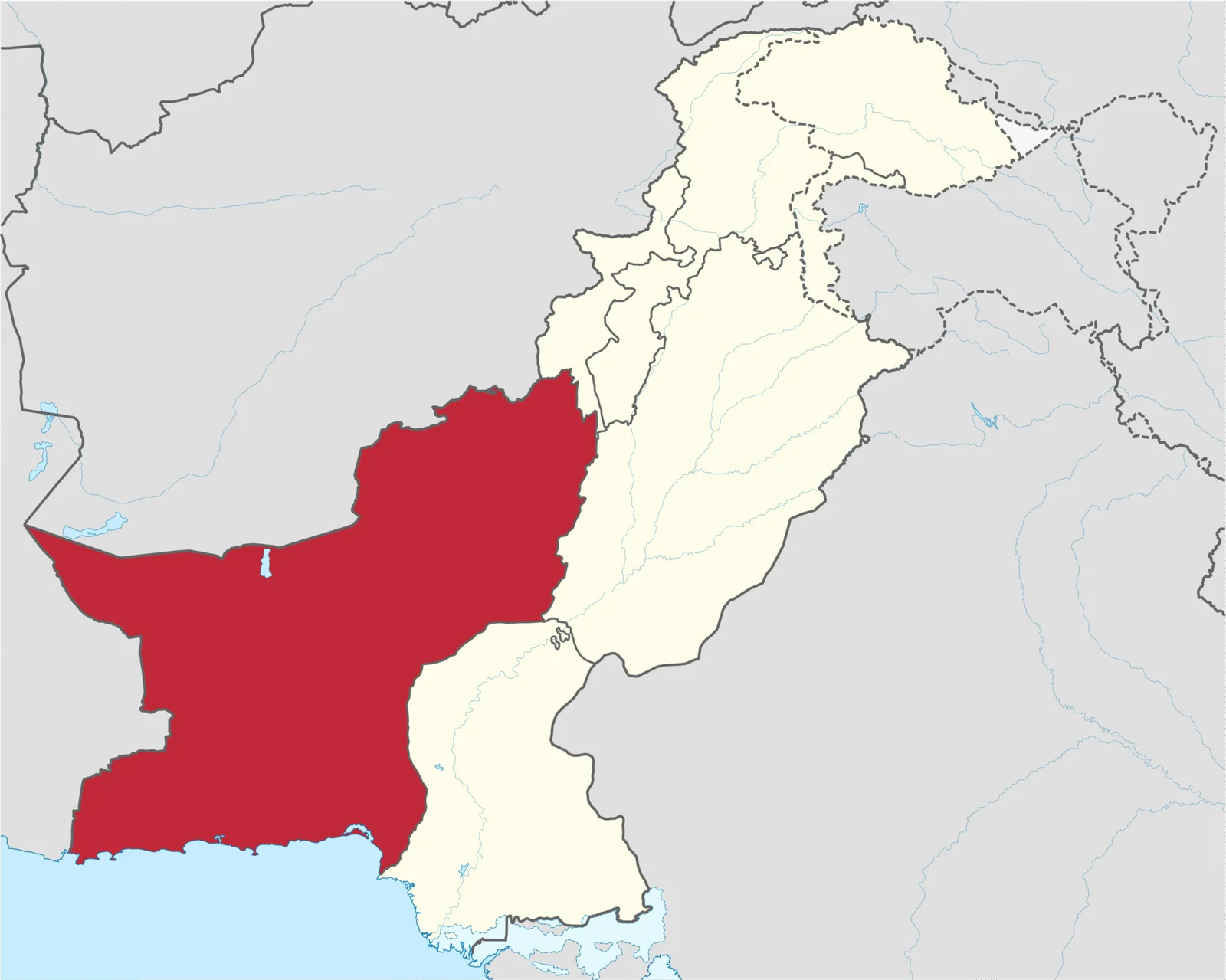

However, performance varies across provinces. Sindh experienced a notable increase in tax revenues, while Punjab and Balochistan showed slower growth. Furthermore, while progress has been made in meeting health and education spending targets, tax reforms, particularly the agricultural income tax, have faced delays, with implementation now slated for 2025.

Looking ahead, provincial governments must prioritize tax reforms, particularly in agricultural income and property taxes, to ensure sustainable fiscal growth and meet long-term financial goals. The success of these initiatives will depend on continued federal support and overcoming political resistance to reform.