Editorial

It appears that the government machinery in Pakistan is disconnected from the economic reality of the country. A recent report has revealed that the Auditor General of Pakistan (AGP) discovered significant tax evasion by all provincial governments, amounting to Rs33 billion from 2017-18 to 2021-22. This negligence is particularly concerning given the country’s severe economic challenges.

The AGP’s investigation unveiled that provincial governments failed to deduct and deposit federal taxes, including income tax, from the salaries of officials. For example, a public sector university in Lahore withheld a substantial sum of Rs166 million in income tax from its employees’ salaries but diverted this amount to fund university operations instead of remitting it to the Federal Board of Revenue (FBR).

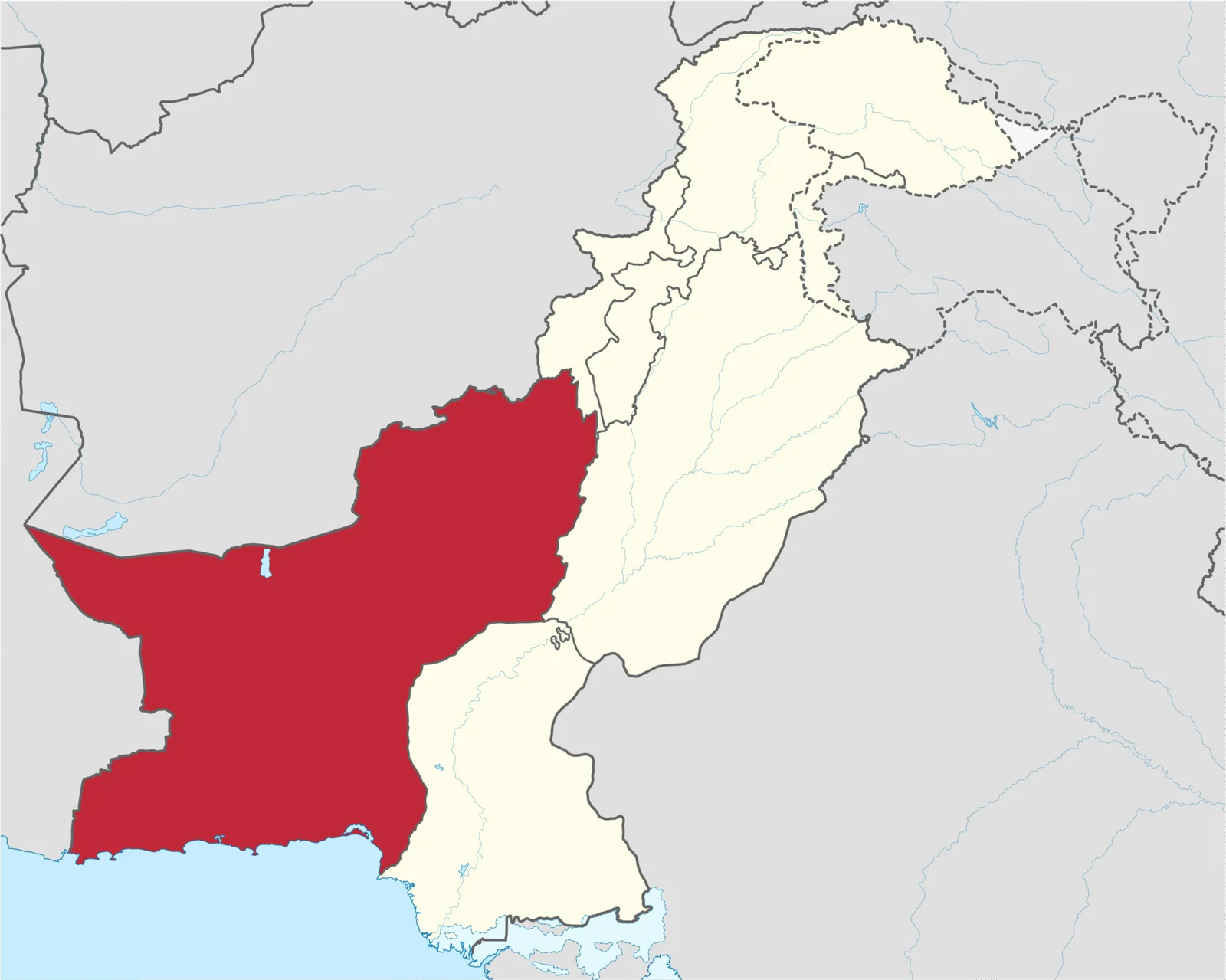

Further examination exposed that the Punjab government evaded taxes worth Rs16.3 billion, Sindh neglected Rs8.6 billion in tax deductions, Khyber-Pakhtunkhwa failed to deposit Rs5.07 billion, and Balochistan owes Rs2.34 billion to the FBR.

Despite the Auditor General’s office alerting provincial chief secretaries about the constitutional obligation to deduct and deposit federal taxes, no tangible progress has been made. Consequently, an in-depth inquiry is imperative to address these violations, and immediate corrective actions must be implemented upon confirmation of tax evasion by provincial governments.

Pl subscribe to the YouTube channel of republicpolicy.com

If the provinces persist in shirking their legal obligations, the federal government must intervene and deduct the relevant amounts from the provinces’ share of the federal divisible pool. Moreover, the provincial governments must not solely rely on federal transfers and should proactively generate tax revenues from new avenues.

The situation is unacceptable, especially given the burden on law-abiding citizens, particularly those in the salaried class. It is crucial for all authorities to swiftly address and resolve this issue to uphold financial integrity and accountability.