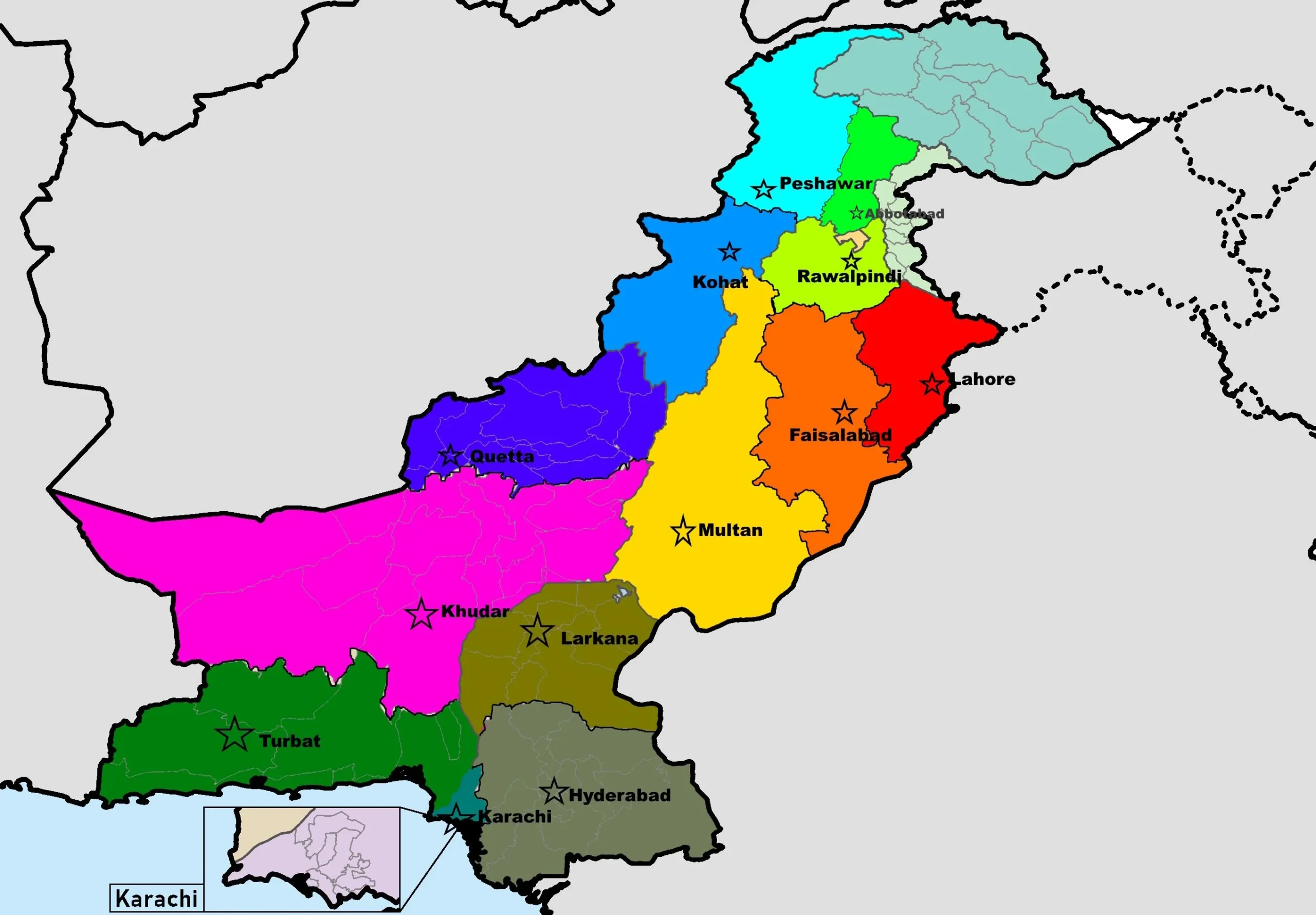

In the first quarter of the current fiscal year, Punjab’s government debt rose by 0.1 percent (Rs 1.7 billion) compared to June 2024. This increase was primarily due to a foreign exchange loss of around Rs 8 billion and a decrease in the net debt position by Rs 6.3 billion.

According to a report from the Punjab Finance Ministry for the period between July 1, 2024, and September 30, 2024, the province’s total debt stood at Rs 1,679 billion by the end of Q1. Of this amount, Rs 1,677 billion was owed to external lenders, while Rs 1.6 billion was from domestic sources. The debt makes up 2.49 percent of Punjab’s Gross State Domestic Product (GSDP), which saw a significant increase from Rs 57,476 billion to Rs 67,289 billion in the same period.

The report indicated that Punjab’s total debt increased slightly from Rs 1,677.1 billion in June 2024 to Rs 1,678.8 billion by the end of Q1. External loans rose by Rs 3.4 billion, while domestic loans declined by Rs 0.1 billion.

The report further clarified that the debt stock as of September 2024 does not include provincial guarantees or commodity debt, which amounted to Rs 103 billion, primarily linked to wheat procurement. Most of Punjab’s debt comes from external sources, with 99.9 percent of it contracted from multilateral and bilateral agencies at low interest rates, mainly for infrastructure and development projects.

The breakdown of the external debt portfolio revealed that 55 percent comes from the International Development Association (IDA) and the International Bank for Reconstruction and Development (IBRD), 21 percent from the Asian Development Bank, 20 percent from China, and 4 percent from other sources.

Agriculture, irrigation, and livestock sectors were the largest recipients of government borrowing, accounting for 25 percent of the total debt. Other key sectors include transport, education, and urban development.

The report highlighted that the government’s debt is predominantly in foreign currencies, with 70 percent in USD, 22 percent in Special Drawing Rights (SDR), 5 percent in Japanese Yen, and 2 percent in Chinese Yuan. The high foreign currency exposure makes Punjab vulnerable to fluctuations in exchange rates. However, most of the debt (73 percent) is on fixed interest rates, insulating it from changes in global interest rates, while 27 percent is subject to floating interest rates that are periodically adjusted.