Zafar Iqbal

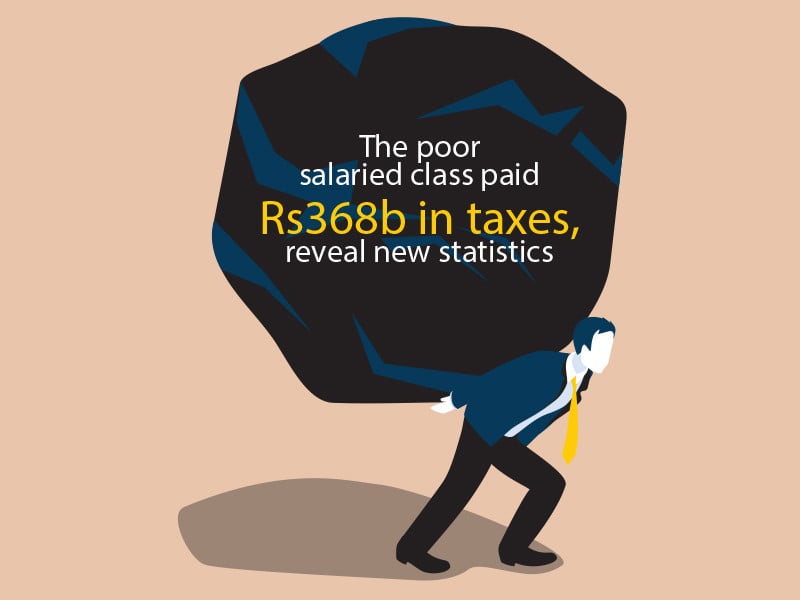

The IMF’s projection of a 30% growth in Pakistan’s Federal Board of Revenue (FBR) tax revenues for the upcoming fiscal year (FY25) underscores the urgent need for tax reforms. This target, challenging to achieve without expanding the tax base and increasing taxation on the existing one, becomes even more pressing as inflation falls and GDP growth remains low. The government must act swiftly to increase taxes on the existing base and introduce new taxes to meet this goal.

The new finance minister’s task of formulating a strategy for generating tax revenues and achieving ambitious growth is fraught with potential risks and challenges. The possibility of alienating the core base of PML-N voters, the discontent of the middle-income rural farming community, and the potential upset of the urban middle class in Punjab due to the budget are all significant concerns. The minister must navigate these challenges with care to avoid exacerbating these issues.

The political tensions within the ruling party, as well as the broader political uncertainty highlighted by the IMF, present a complex landscape for the finance minister. The IMF’s warning of a resurgence in social tensions and the high cost of living further complicates policy and reform implementation. The minister must navigate these challenges with care to ensure effective policy execution.

There are two major challenges: achieving higher tax revenue growth and securing external financing. The finance minister faces twin pressures: achieving high tax revenues and securing an optimistic amount of external financing from private creditors. If the latter falls short, the gap must be filled by reducing the current account deficit, which may prove challenging and could hinder efforts to achieve 2-3 per cent GDP growth, further complicating revenue growth targets.

The question arises: where will higher taxes be collected, especially when many sectors, such as automobiles, steel, and white goods, are operating at only half capacity? Further taxation could dampen sales and encourage informality. In sectors where taxation has increased, market share has shifted to informal players offering inferior products, as seen in petroleum, tobacco, and juices.

If taxes on salaried individuals and formal businesses increase further, marginal individuals may be pushed toward informality, shrinking formal sector employment. We understand that the finance minister needs to develop a strategy that does not alienate the ruling party’s core base of voters and navigate a slew of challenges carefully. The challenges ahead are daunting, and unless the government addresses them effectively, it may face significant economic and political consequences. Your understanding and support in this process are crucial.

Taxation reforms are critical for the economic growth of a country. Pakistan has been struggling with low tax revenues, and the Federal Board of Revenue (FBR) has been identified as a key institution that needs to be reformed. The FBR is responsible for collecting tax revenues, but it has been facing numerous challenges, including revenue leakages, corruption, and a lack of capacity and skills among its human resources.

One of the key challenges with the FBR is its civil service structure, which is outdated and does not align with modern tax administration practices. The FBR’s large workforce is hindered by a lack of necessary skills and training, preventing them from effectively carrying out their duties. To address this, the FBR needs to reform its civil service structure to ensure a skilled and motivated workforce that can effectively collect tax revenues.

Another key challenge with the FBR is its inland revenue service. The inland revenue service is responsible for collecting taxes on income, sales, and property. However, the inland revenue service has been facing numerous challenges, including a lack of capacity and skills, corruption, and political interference. The inland revenue service needs to be reformed to ensure that it is effective in collecting tax revenues.

To reform the FBR’s civil service and inland revenue service, the government needs to take a comprehensive approach. By investing in training and capacity building for FBR employees, we can ensure that they have the necessary skills to effectively collect tax revenues. Introducing merit-based recruitment and promotion policies will ensure that the most qualified individuals are hired and promoted within the FBR, leading to a more efficient and effective tax collection system.

Furthermore, the government needs to introduce reforms to reduce corruption and political interference within the FBR. The government needs to establish an independent oversight body to monitor the FBR’s activities and ensure that there is no corruption or political interference. The government also needs to introduce transparency measures, such as publishing the FBR’s tax collection data on a regular basis.

Therefore, tax reforms are critical for Pakistan’s economic growth, and the FBR is a key institution that needs to be reformed. The FBR’s civil service and inland revenue service need to be reformed to ensure that they have the necessary capacity, skills, and motivation to effectively collect tax revenues. As key stakeholders, the governmental role in implementing these reforms is crucial. The government needs to take a comprehensive approach to reforming the FBR, including investing in training and capacity building, introducing merit-based recruitment and promotion policies, and reducing corruption and political interference.