Fajar Rehman Khan

The latest data released by the State Bank of Pakistan shows that foreign direct investment remains weak and uncertain. During July to November 2026, Pakistan received foreign direct investment worth 1.47 billion dollars, compared to 2.15 billion dollars in the same period last year. Although capital outflows declined, the overall picture remains troubling. These numbers confirm that foreign investors are still reluctant to commit long term capital to Pakistan, despite repeated official claims of economic stabilisation.

Privatisation figures raise further questions. Official data shows zero privatisation proceeds for the period, even though the Prime Minister publicly announced the sale of the First Women Bank to an Abu Dhabi based company. The deal was valued at around 14.6 million dollars, yet the actual transaction details have not been disclosed. This lack of clarity weakens investor confidence because transparency is a core requirement for credible markets. When announced deals do not appear in official data, investors assume governance risk.

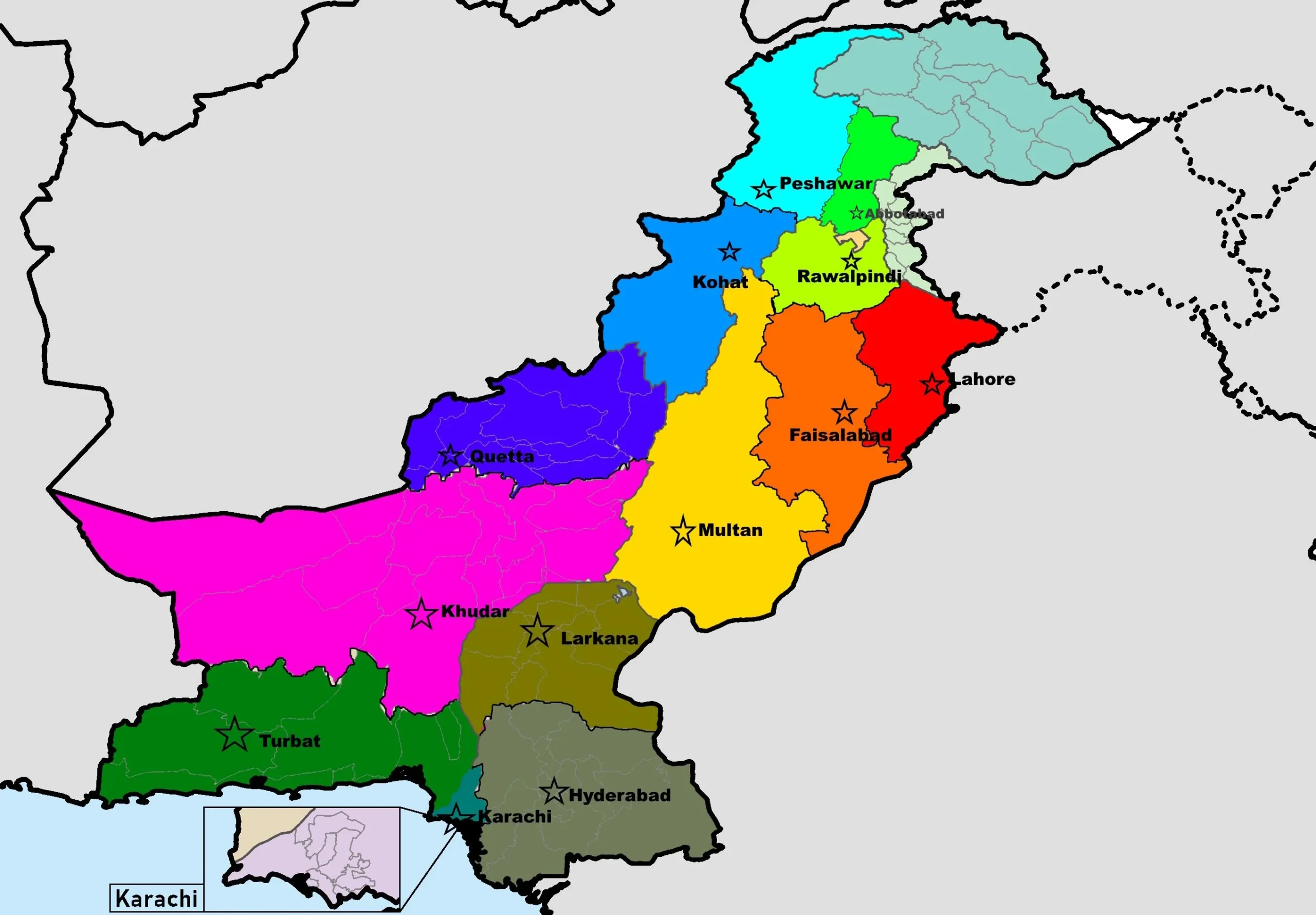

The International Monetary Fund’s review under the Extended Fund Facility and the Sustainability Resilience Facility reinforces these concerns. The IMF estimates foreign direct investment at only 0.5 percent of GDP for the current year, down from 0.6 percent last year. This is extremely low for a country seeking growth, employment, and export expansion. The Fund also flagged the Special Investment Facilitation Council as a powerful body operating with untested transparency and accountability. Such observations from the IMF matter because they shape global investor perception.

The IMF has clearly asked the government to identify and disclose all foreign investments routed through the SIFC, including any fiscal or monetary incentives offered. This reflects a deeper concern that investment decisions may be driven by discretion rather than law. Investors value predictability. When investment facilitation depends on special councils instead of stable institutions, risk premiums rise and capital stays away.

At the same time, Pakistan has committed under the Memorandum of Financial and Economic Policies to avoid new tax breaks, subsidies, or preferential credit. This creates a contradiction. On one hand, the government seeks large foreign inflows. On the other, it promises not to offer incentives. Without structural reforms, infrastructure readiness, legal certainty, and political stability, investment cannot arrive simply through memoranda of understanding.

The government often highlights signed MOUs worth more than 25 billion dollars. However, MOUs are not investments. They are expressions of intent, not binding contracts. In Pakistan’s history, many MOUs never convert into actual projects because political changes, policy reversals, and bureaucratic delays interrupt execution. Investors are fully aware of this pattern.

Pakistan’s geopolitical relevance has increased in recent months. High level foreign visits and strategic engagements signal renewed international interest. However, geopolitics alone does not produce factories, jobs, or exports. Investment decisions depend on domestic conditions. Without political stability, even strategic allies hesitate to commit capital for long term projects.

The current account numbers also require careful reading. While November recorded a surplus, the broader trend is mixed. The current account balance deteriorated when compared year on year. The trade deficit in goods expanded significantly, and services trade remained negative. The only strong support came from workers’ remittances, which increased to over 16 billion dollars. Even this inflow is expected to slow, according to IMF projections.

Remittances are not a substitute for investment. They support consumption, not productivity. They do not create export capacity or industrial depth. An economy relying on remittances without investment remains vulnerable. Factories closing, multinational companies exiting after decades, and rising unemployment all point to structural weakness rather than recovery.

Political stability is central to reversing this decline. Investment requires policy continuity, institutional credibility, and predictable governance. In Pakistan, frequent changes in government, shifting economic teams, and politicised accountability systems create uncertainty. Investors delay decisions because they fear contract renegotiation, regulatory reversal, or administrative obstruction after political transitions.

Stable politics also reduce elite capture. Currently, economic policy often protects narrow interests. The reversal of the April 2025 notification allowing reemployed pensioners to draw both salary and pension reflects this problem. When governments cannot resist elite pressure, fiscal credibility suffers. Investors see this as a sign that reforms will not be sustained.

Political stability strengthens civilian authority over economic management. When economic decision making is fragmented across multiple power centres, accountability disappears. Investors prefer clear lines of authority. A stable political system ensures that commitments made today will still hold tomorrow.

Moreover, political stability enables long term reform. Tax reform, energy restructuring, export competitiveness, and civil service reform all require time. Unstable governments focus on survival, not reform. As a result, policies remain short term, reactive, and inconsistent. Investment cannot thrive in such an environment.

Until reforms begin to show real results, Pakistan may need to rethink its external financing strategy. Seeking loan restructuring, waivers, or longer maturities may be more realistic than expecting foreign direct investment to arrive in a fragile political and economic environment. Investment follows strength, not promises.

In conclusion, Pakistan’s macroeconomic indicators do not yet support claims of durable recovery. Falling investment, rising trade deficits, factory closures, and job losses paint a sobering picture. Foreign investors are not irrational. They respond to signals. Without political stability, institutional reform, and credible governance, Pakistan will remain stuck in a cycle of low investment and high vulnerability. Political stability is not a luxury. It is the foundation on which investment, growth, and economic sovereignty are built.