The significance of worker remittances for Pakistan is underscored by the substantial $8 billion that flowed into the country during the first quarter of FY25, comparable to the $7 billion received over 37 months through the Extended Fund Facility (EFF) by the IMF. These remittances play a pivotal role in bolstering Pakistan’s economy, particularly by significantly contributing to its foreign exchange reserves. The recent surge in inflows has been especially crucial as the country experiences a stabilization in repatriation outflows.

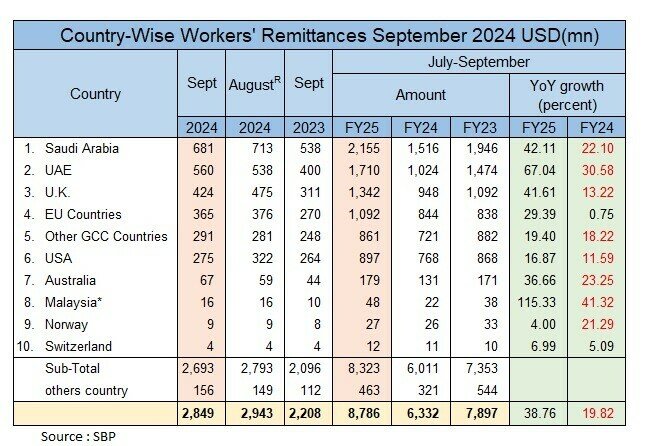

As of 3QFY25, remittances reached $8.8 billion, indicating a notable 39 percent year-on-year increase. In September 2024 alone, the country received $2.85 billion in remittances, marking a 29 percent year-on-year increase. However, on a month-on-month basis, the September 2024 remittances showed a slight decrease of 3 percent. This year-on-year growth can be attributed to overseas Pakistani workers sending funds back home, particularly from key markets like Saudi Arabia, the UAE, the UK, and the USA. Furthermore, factors such as a strengthening Pakistani rupee, a narrowing gap between open market and interbank rates, and a rise in the number of workers migrating abroad have contributed to the growth in remittances. The government and the State Bank of Pakistan (SBP) have also implemented policies to promote the use of formal channels for sending remittances, such as [specific policy measures].

Saudi Arabia and the UAE remain the largest contributors to remittances, with year-on-year growth of 42 percent and 67 percent respectively in 1QFY25. However, it’s important to note that other key markets, such as the UK, USA, and EU countries, are also showing positive growth rates, albeit smaller. This diversity in remittance sources is a positive sign for Pakistan’s economy.

Countries such as India, Mexico, the Philippines, Bangladesh, Egypt, and Vietnam also heavily rely on remittances from Middle Eastern countries such as Saudi Arabia and the UAE, as well as from Western economies like the USA and the UK. In terms of GDP percentage, remittance shares in these countries range between 5 percent and 9 percent, with Pakistan being more dependent on them than larger economies like India.

To ensure the continued strength of these critical inflows, the focus should be on strengthening formal remittance channels and maintaining a competitive exchange rate. In the long term, the stability of economic policies will be crucial to sustaining remittance inflows. Providing enhanced incentives for formal remittance channels will further bolster these inflows. Recently, the SBP announced a threefold increase in monetary incentives for exchange companies to encourage the mobilization of remittances, a step towards this stability.