ISLAMABAD: Pakistan is seeking confirmation from Saudi Arabia to secure additional deposits of $2 billion and a $950 million loan from the World Bank and Asian Infrastructure Investment Bank (AIIB) for the signing of a Staff-Level Agreement (SLA) with the International Monetary Fund (IMF) within the coming week, reported The Republic policy.

“We are hopeful,” a government official dealing with the IMF replied when asked about the development.

The World Bank’s Resilient Institution for Sustainable Economy (RISE-II) has offered AIIB lending of $950 million only if Pakistan secures the IMF bailout.

Another official assured that Pakistan expected to strike the SLA with IMF in the next few days. However, the Fund was reluctant to give any time frame for finalising the agreement.

China had already re-financed two commercial loans of $1.2 billion in two instalments, $700 million and $500 million. In the coming days, two more instalments of $500 million and $300 million would be re-financed by Chinese commercial banks.

Pakistan is facing difficulty in its talks with IMF due to the increased hostility between China and the United States. They must secure the SLA in a delicate balancing act to steer the economy and diplomacy in a way that suits Islamabad’s more considerable interest.

China has come to rescue Pakistan at a challenging time as Beijing re-financed its commercial loans before signing the agreement with the lender.

“It’s a great help from the Chinese friends, and Islamabad expects that they will also roll over the deposits in the coming weeks,” said official sources.

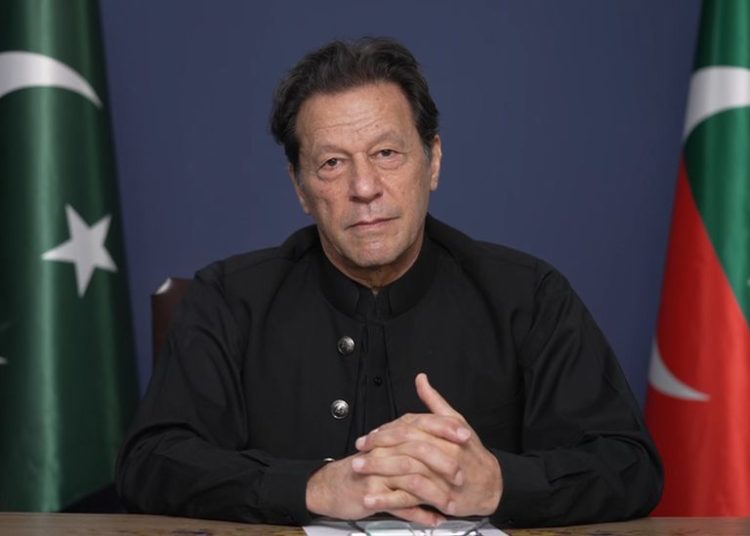

Pakistan had implemented all prior actions to secure the revival of the IMF programme to accomplish the pending ninth review and release of the vital $1 billion tranche under the Extended Fund Facility (EFF) signed in 2019 by the Imran Khan government.

Under the prescription of the IMF, the government had taken several measures, including the unveiling of a mini-budget for fetching additional tax revenues of Rs170 billion by raising the GST rate from 17% to 18%, raising power tariff by over Rs7 per unit, another imposition of power surcharge of Rs3.82 per unit, increasing gas tariff, allowing massive adjustment in the exchange rate, increasing petroleum development levy and hiking policy rate by 300 basis points, jacking it up from 17% to 20%.

Pakistan is eyeing to jack up its foreign exchange reserves to $10 billion by the end of June 2023, which, at the moment, stood at around $4 billion after getting two instalments of commercial loans from Chinese banks.