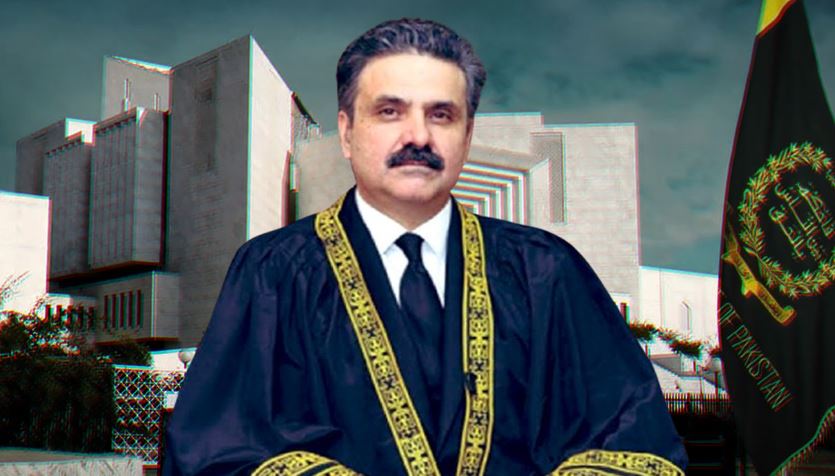

Zafar Ali

The current budget for the upcoming fiscal year is ambitious, aiming to achieve high taxation growth, which the country critically needs. However, it lacks concrete measures to support this ambitious target. Negotiating tough International Monetary Fund (IMF) conditionalities, the government made efforts to navigate through taxation demands on various sectors such as agriculture, sugar sales tax, and higher taxes on salaried individuals. Despite this negotiation, there are concerns about the clarity and feasibility of achieving the targeted growth in Federal Board of Revenue (FBR) revenues, direct taxes, and sales tax.

The budget reflects a generous increase in government employees’ salaries and a doubling of the federal development budget. This raises questions about the government’s priorities and the potential impact on the overall economic outlook. There are deliberate efforts to protect certain core constituents while imposing taxes on exporters and small and medium enterprises, creating an imbalance in tax distribution.

The budget also introduces changes in taxation for different sectors, such as imposing a maximum slab of 45 percent on non-salaried individuals, affecting the tax-compliant small and medium enterprise (SME) sector. The lack of equity in tax measures for non-salaried persons, retailers, wholesalers, and other sectors is a concerning issue raised by critics.

Regarding non-tax revenues, the reliance on profits from the State Bank of Pakistan (SBP) and petroleum levy may help lower the fiscal deficit but raises concerns about the sustainability of such measures. Additionally, the proposal to treat capital market income as normal income tax was not imposed, raising questions about the government’s stance on market-friendly policies.

Overall, there are doubts about the budget’s ability to achieve its revenue targets, the potential inflationary consequences of certain tax measures, and the need for additional measures to achieve the fiscal deficit target. The lack of transparency and clarity on how these targets will be met has sparked scepticism and concern among experts and the public alike.

The budget for 2024-25, often compared to a five-legged kangaroo, is burdened by the weighty demands of the International Monetary Fund (IMF), symbolized by the first leg. This is not just a challenge, but a significant hurdle that the government must navigate, as it sets the tone for the rest of the budget’s constraints.

In this analogy, the fifth leg of the kangaroo is represented by Nawaz Sharif, the leader of the Pakistan Muslim League-Nawaz, who wields influence despite the obstacles faced by the government.

Despite these challenges, the Finance Minister’s claims of stability and growth are not just met with skepticism, but with a strong sense of doubt due to past unfulfilled pledges, symbolized by the fifth leg of the kangaroo. The audience is left questioning the feasibility of these claims and the potential impact on the budget, emphasizing the need for more transparency and accountability.

However, the budget allocated for new sovereign guarantees suggests that foreign investment inflows may not be supported as anticipated. The Finance Minister also highlighted the government’s intention to engage only in essential services and not in business, a stance that may align with capitalist practices in the United States but seems outdated in the context of the rest of the world.

Despite the Finance Minister’s promise to reduce wasteful expenditure, the current expenditure budget indicates a significant rise, contradicting IMF projections. The allocation for various expenditures, including pensions, mark-up on debt, civilian administration, and subsidies, has not just raised concerns, but has sparked a sense of urgency about the excessive burden on taxpayers and the overall economic outlook.

Furthermore, the budgeted rise in defence outlay and petroleum levy, along with the lack of clarity on revenue generation from various measures, underscore the challenges and uncertainties surrounding the budget for the upcoming fiscal year. While the government’s projected deficit appears marginally lower than the previous year, there are doubts about the feasibility of its revenue targets and the overall economic projections.