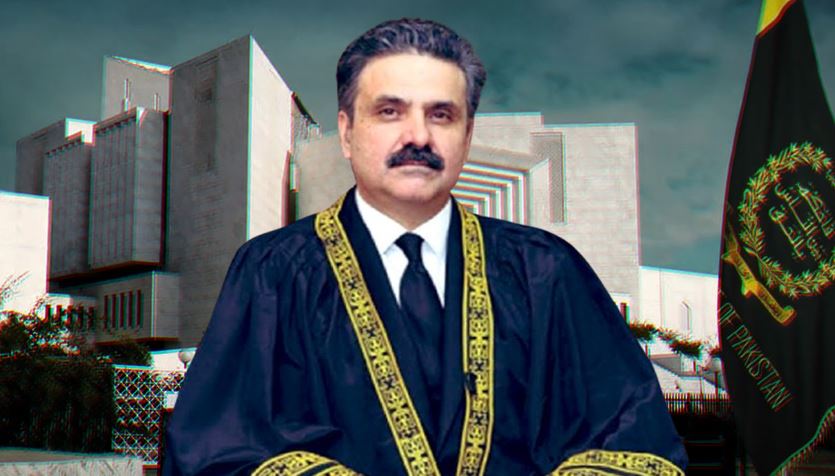

Zafar Iqbal

The recent conclusion of the IMF second review has stirred a considerable amount of attention. While a staff-level agreement was not reached this time, in contrast to the previous November review, the overall sentiment is not entirely negative. The implications of this review on Pakistan’s economic conditions are significant. It is anticipated that certain prior actions, such as potential increases in petroleum levy, gas prices, pending fuel adjustments in power tariffs, and GST on goods with low rates, might be taken before the upcoming board meeting in the third week of March.

It’s worth noting that all the performance criteria for the second review were comfortably met. However, there are some issues with indicative targets (not requiring waivers) and structural benchmarks (which might necessitate waivers). This occurrence of not reaching a staff-level agreement during a review is not unprecedented, and obtaining a waiver is not a significant concern, as demonstrated by past experiences. Despite the recent media attention, it’s essential to emphasize that the situation does not warrant a heightened sense of alarm.

Despite the challenges, Pakistan’s economic performance has shown remarkable resilience, surpassing initial expectations, particularly in the external account. Both net international reserves and the reduction of forward/swap liabilities have exceeded the targets set in September 2020. With reserves on the State Bank of Pakistan’s balance sheet improving by $5.2 billion since July 2019 and off-balance sheet liabilities decreasing by $4 billion, the overall improvement amounts to $9 billion. Notably, a significant portion of this improvement, $3 billion, stems from portfolio investments, which indicates a substantial and sustainable enhancement rather than speculative inflows.

While there are challenges in the fiscal and energy sectors, it’s worth acknowledging that all the binary targets were met in December 2019, and it is likely that they will also be met in March 2020. The challenges in the fiscal sector include [specific challenges], while the energy sector is grappling with [specific challenges]. This suggests that there may be room for negotiation, as the authorities have demonstrated commendable performance in certain areas. Considering the positive tone of the statement, the possibility of the board rejecting a tranche in the coming weeks seems misplaced.

The IMF has explicitly stated that the real exchange rate is broadly in line with fundamentals, further signalling that the currency is not likely to face significant pressure. Additionally, the declining trend in inflation provides a supportive backdrop, hinting at the possibility of monetary policy easing in the coming months, around July or September. While some discord exists concerning fiscal matters, the IMF has acknowledged the government’s strong fiscal performance in the first half.

Despite these encouraging elements, it’s crucial to address the lingering challenges in FBR revenues and power tariffs. The government’s ability to address these issues in the current review is uncertain, and it is evident that these issues will continue to pose challenges in subsequent reviews. Implementing new taxes at this juncture could potentially be counterproductive, potentially leading to inflationary pressures and further impeding economic growth. The political capital required for such moves is also a consideration the government cannot afford to overlook.

Amid these challenges, there is a glimmer of hope in the form of declining oil prices following the outbreak of the Coronavirus. The Ministry of Finance may be contemplating leveraging this situation by increasing the Petroleum Levy (PL) without fully passing on the oil price decline benefits to consumers. The incremental revenue from this move could contribute to curbing the fiscal deficit. However, this alone may not be sufficient, and it is anticipated that new taxes may be introduced in the upcoming budget. Furthermore, signs of economic recovery, such as the growth in Large Scale Manufacturing (LSM) and the potential bottoming out of import compression, provide additional reasons for cautious optimism. As FBR revenues growth is closely linked to imports and LSM growth, these developments could bode well for the country’s fiscal performance.

Presently, the most critical challenge lies in the power sector tariffs. The structural benchmark for notification of Q2 FY20 electricity tariff adjustment for capacity payments is a looming issue. While the government may seek a waiver in this regard, growing capacity payments for new power plants present a significant obstacle to the fledgling economic recovery. The Finance Minister’s recent acknowledgment of the potential catastrophic impact of energy woes, as well as the PM’s vocal stance on the issue, underscores the gravity of the situation. To address this, potential strategies could include [specific strategies], which would [specific outcomes].

Addressing these challenges will necessitate negotiations on the existing lopsided Independent Power Producer (IPP) contracts. A substantial portion of capacity payments is attributed to debt repayment, creating significant financial strain. For instance, in the case of the coal power plant at Port Qasim under the China-Pakistan Economic Corridor (CPEC), the Power Purchase Agreement (PPA) spans 30 years, with the bulk of the debt repayment concentrated in the initial ten years. The pressing need for renegotiating these agreements is clear, and similar issues are prevalent in the context of RLNG plants. The potential impact of renegotiating these contracts could include [specific benefits], but there are also risks involved, such as [specific risks]. It is imperative that Pakistan explores avenues for renegotiating these contracts, as evidenced by similar efforts by other countries facing similar challenges.

In guiding these complex issues, Pakistan is considering three primary options. The government’s proactive approach involves reducing capacity payments through negotiations and focusing on improving the governance of distribution companies. This strategy, coupled with seeking waivers within the IMF’s permissible limits and working towards an eventual resolution, instills confidence in the government’s ability to manage the situation. However, achieving this would be contingent on bolstering reserves to a certain level, a target that the Finance Minister has suggested stands at $20 billion, with the current reserves at $12.4 billion. Notably, prepaying the IMF, as was done under the leadership of Shaukat Aziz, is not a viable option at present. Ultimately, the government is compelled to address the issue of IPPs through negotiations as a fundamental strategy to address these challenges.