Zafar Iqbal

Pakistan’s Economic Future Hinges on New IMF Programme Amidst Challenges

Pakistan is currently facing persistent economic challenges, and the resolution of these issues depends on the IMF’s new programme and Pakistan’s commitment to future conditions. The successful implementation of this programme could potentially lead to Pakistan’s economic recovery. Notably, this would be Pakistan’s third IMF programme since 2019.

The previous Extended Fund Facility (EFF) worth US$6 billion, which was later extended to US$7 billion, ended prematurely in June 2023. Subsequently, in July 2023, Pakistan signed a US$3 billion standby arrangement (SBA) at the request of Prime Minister Shehbaz Sharif, and negotiations are ongoing for a new agreement with the IMF.

However, concerns have emerged regarding potential inaccuracies in the IMF team’s estimates of Pakistan’s current account deficit and loan payments, sparking debate within the country.

Delays in signing staff-level agreements and disbursing payments have resulted in the premature lapse of the EFF, leading the government to impose stringent conditions to stabilize the economy. This has triggered inflation and policy rate hikes, impacting the overall business climate negatively.

The strict adherence to these conditions has led to uncertainty and has significantly affected importers and various sectors, raising concerns about the IMF team’s competence and the necessity for investigations into potential political motives behind these miscalculations.

The IMF’s latest report indicates emerging signs of economic stability, with a gradual decline in inflation and relief from external pressures. However, the overall economic outlook remains challenging, with significant downside risks.

To address these issues, Pakistan must focus on fostering political stability and addressing judicial crises. It is crucial to revamp the judicial system to ensure transparency and accountability, including implementing a proper system for the appointment of judges with rigorous screening mechanisms.

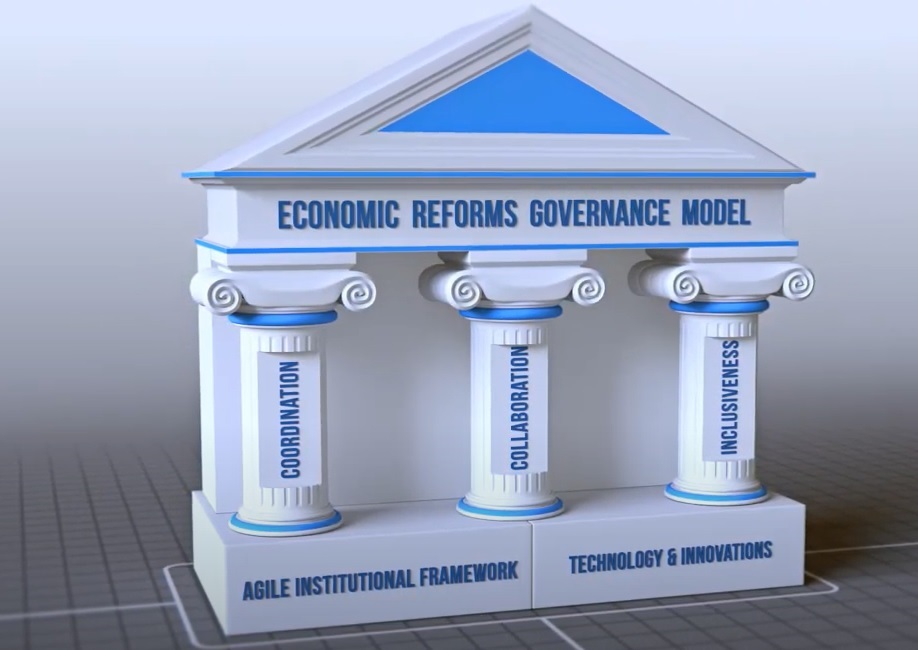

Additionally, fundamental governance issues need to be addressed, with a focus on economic stability and growth. Leveraging positive assessments from the IMF, Pakistan should prioritize economic policies conducive to growth, revenue collection, GDP expansion, and attracting foreign direct investments.

Swift implementation of reforms, particularly in tax enforcement and digital invoicing, will be crucial in strengthening economic resilience and paving the way for sustained growth and stability.

Securing loans can be a matter of celebration for a nation as it provides temporary relief, but it is crucial to acknowledge that these loans come with the responsibility of repayment, often with interest and domestic conditions, making them a challenging burden. While many nations take out loans to reform and restructure their economies, in Pakistan’s case, the loans are often utilized to pay back existing debts and bridge the gaps in its import-based economy.

Pakistan has been grappling with a persistent decline in its currency since its inception, and the continuous trend of imports outweighing exports has led to a devaluation of the currency and a shortage of foreign reserves. The underlying issue lies in the import-oriented structure of the economy, and unless Pakistan transitions to an export-based economy, it will continue to face liquidity crises. Addressing these challenges requires short-, medium-, and long-term economic plans.

It’s important to recognize that loans are not inherently negative for an economy. Many world economies have successfully utilized loans to recover from recessions and financial crises. However, in the case of Pakistan, the challenge lies in effectively utilizing these loans to revamp the economy rather than perpetuating the cycle of debt repayment. Loans can provide short-term breathing room for an economy and should be utilized for sustainable reform and restructuring.

Pakistan takes loans from the IMF for various reasons, including stabilizing its economy, addressing imbalances, coping with shocks, restoring investor confidence, and creating breathing room for implementing policies that restore economic stability and growth. However, the critical question remains whether Pakistan effectively utilizes these funds. The country often finds itself caught in a cycle of using loans to pay off existing debts, highlighting the urgent need for economic restructuring.

To successfully complete IMF loan programs, Pakistan should consider implementing proactive monetary policies to combat inflation, prioritize boosting revenue through a primary surplus, resume reforms, promote prudent macroeconomic policies, and meet the IMF’s conditions for the release of loan tranches. It’s crucial to implement the agreement in letter and spirit to secure future deals with the international community.

Maintaining solid foreign reserves, particularly in dollars, is essential for Pakistan. Achieving this goal requires restructuring the economy by maximizing exports. Diversifying exports, attracting foreign direct investment, improving tax collection, seeking alternative sources of financing, and enhancing the digital economy are all essential strategies for ensuring liquidity beyond relying solely on IMF and other forums.

Concludingly, while an IMF deal may provide temporary relief from economic pressures, the long-term solution lies in restructuring the economy to prioritize exports and diversification, ensuring a sustainable and resilient economic future for Pakistan.