Editorial

The federal finance minister, Muhammad Aurangzeb, recently presented the Shehbaz Sharif-led government’s maiden budget in the National Assembly. This budget, however, is not solely a product of the government’s decisions, but also a result of the conditionalities set forth by the International Monetary Fund (IMF), which the government must navigate to meet its fiscal goals.

The budget proposals are a clear reflection of the government’s compliance with the IMF’s stipulations, termed ‘Home Grown’, as the finance minister expressed that there is no alternative but to adhere to an IMF program. The situation of the national economy is well-known, as is the solution it mandates. The persistent reluctance of successive governments to break the elite’s grip on the economy has exacerbated the current economic quagmire. Now, more than ever, there is an undeniable need for the government to take bold actions to enforce the state’s authority and steer the economy in a new direction.

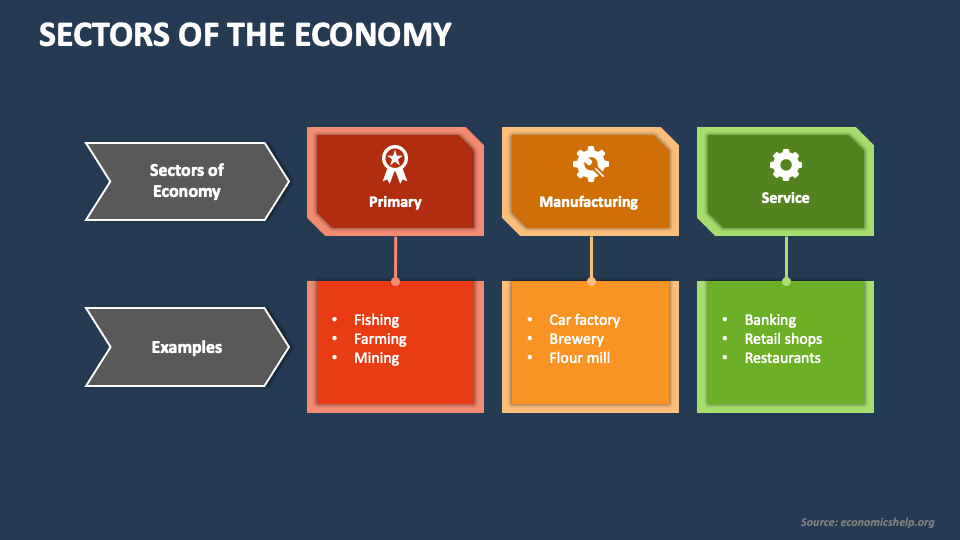

The budget strategy for FY2024-25 aims to achieve economic stability and growth through fiscal consolidation, bringing the public debt to GDP ratio to sustainable levels, and prioritizing improvements in the balance of payments position. It also focuses on revitalizing the private sector, pro-poor initiatives, and integrating green and gender-responsive budgeting into public finance management.

The proposed budget, amounting to Rs 18,877 billion, demonstrates the government’s commitment to fiscal discipline. With Rs 12,970 billion projected as total revenue to be collected by the Federal Board of Revenue (FBR), and non-tax revenue of 4,845 billion rupees, the government is taking significant steps to manage its finances. After adjusting for provincial transfers, the net revenue receipts of the federal government would be Rs 10,377 billion. Additionally, the budget signals an increase of around 20 percent in the salaries and pensions of government employees, a move that, while contributing to concerns about fiscal discipline, also reflects the government’s dedication to its workforce.

Sales Tax and income tax are the major contributors to federal taxes, but the significant increase in income tax projections raises suspicions due to potential revisions in tax rates and categories. However, measures like removing the ‘presumptive tax’ regime for exporters and imposing Federal Excise Duty on property transactions have raised concerns about potential consequences, such as increased tax burdens on certain sectors and potential impacts on the real estate market.

The budget’s lack of customary details and the Pakistan People’s Party of Parliamentarians’ initial boycott of the budget proceedings highlights the potential challenges the government may face in parliament. It underscores the importance of staying the course and addressing economic challenges with a sense of urgency and concern.

In essence, the budget’s alignment with IMF conditionalities and its implications for various sectors of the economy raise critical questions about the government’s fiscal policies. These policies, if not carefully managed, could have a significant and potentially long-term impact on the economic landscape. This underscores the need for a thorough understanding of the budget and its implications, and the importance of informed decision-making in these challenging times.