Zafar Iqbal

The impact of global conflicts on the world economy can be far-reaching and multifaceted. One of the most significant ways in which conflicts can affect the economy is through their potential to disrupt international trade and investment. In the case of geopolitical tensions between nations, trade relations may be strained or even cut off, leading to significant economic consequences as supply chains are disrupted and markets are affected. For example, export-oriented industries may suffer as demand for their goods and services declines due to trade restrictions or embargoes.

Additionally, such conflicts can contribute to uncertainty and volatility in financial markets, leading to negative impacts on investor confidence and capital flows. This can manifest in a variety of ways, such as changes in exchange rates, stock market fluctuations and changes in interest rates. Furthermore, conflicts can also have an indirect impact on the economy by contributing to higher levels of government spending on defence and security, which can divert resources away from productive economic activities, leading to slower growth and economic stagnation. Overall, the impact of global conflicts on the world economy is complex and multifactorial, underscoring the importance of peace and cooperation between nations as a means of promoting economic stability and prosperity.

The year 2024 is anticipated to be a time of relative optimism, but it is also expected to present significant challenges. The COVID-19 pandemic has already left a lasting impact on the global economy, with numerous businesses shutting down and both developed and developing nations grappling with inflationary pressures.

Furthermore, the geopolitical situation has added to economic uncertainties, particularly with the Russia-Ukraine conflict, which has reverberated across the world, impacting the economies of the European Union and the United States. The situation has also intensified the economic volatility of the unresolved tensions stemming from the Israel-Palestine conflict, particularly following the devastating attack in October 2023 that resulted in the loss of thousands of lives.

The cumulative effect of these crises has accentuated the fragility of global economic growth and heightened uncertainties regarding future trajectories.

In addition to these global conflicts, 2024 is also marked as an election year in various countries. Alongside the European Parliament Elections set for June 6-9, 2024, the United States and numerous other nations are gearing up for their electoral processes.

In Pakistan, the general elections held in February 8, 2024, resulted in a fragmented outcome, with no party securing a clear majority to form a government. As a result, a coalition government was formed by the two major political parties, Pakistan Muslim League-Nawaz (PML-N) and Pakistan People’s Party (PPP). Despite allegations of electoral irregularities from opposition factions, the government is now operational and focused on revitalizing the country’s economy and addressing pressing socio-economic challenges.

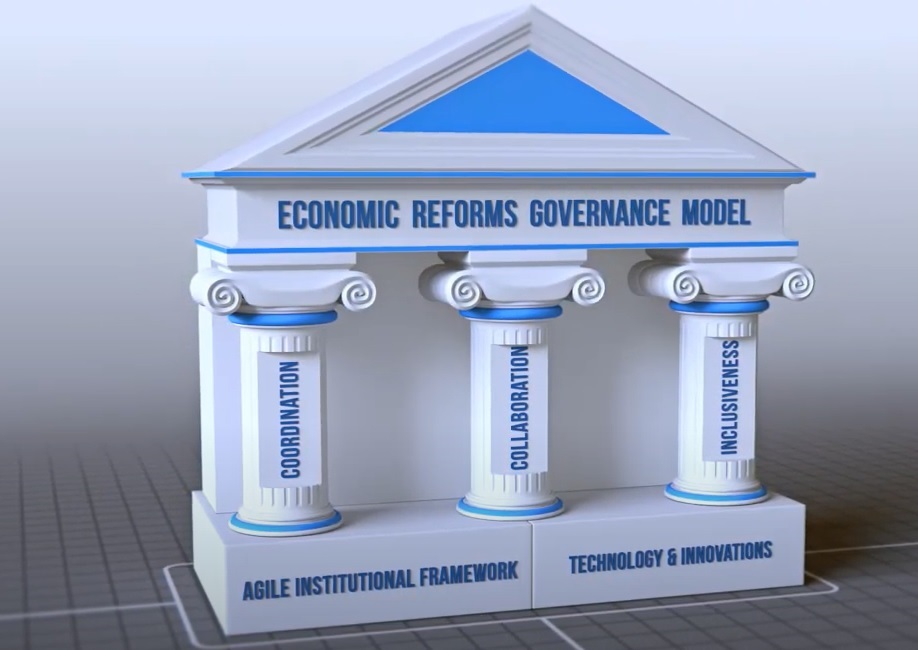

However, the newly formed government has yet to propose innovative solutions to tackle the prevailing economic difficulties. The Finance Minister’s lack of direction in devising revenue generation strategies is quite concerning, and the approach of relying on judicial rulings to favour government taxation is worrisome. This approach overlooks the reality that assessing officers often issue arbitrary and inconsistent orders, and dependence on legal outcomes highlights a broader issue of strategic planning and foresight within the finance ministry.

It is imperative for the government to proactively explore comprehensive measures that go beyond litigation-dependent approaches, ensuring a more robust and sustainable economic trajectory. Furthermore, it is essential for the Finance Minister to recognize that the government’s success rate in both the High Court and Supreme Court is less than 5%. While the minister may possess commendable administrative experience, his educational background lacks expertise in economics, public policy, and public financial management.

Therefore, it would be prudent for the government to consult with industry experts when formulating revenue generation measures. Collaborating with professionals well-versed in economic and financial matters can enrich the policymaking process and enhance the effectiveness of revenue generation strategies.

Apart from Pakistan, the United States is gearing up for its own election on November 5, 2024. The Democratic candidate is expected to retain the presidency, barring any disqualifications or convictions of Donald J. Trump. Trump faces multiple legal challenges, including his Hush money trial, which is scheduled to commence on April 15.

Meanwhile, India has announced a six-week election schedule starting on April 19, 2024, for the Lok Sabha polls. Indian Prime Minister Narendra Modi is seeking a third term, but his opponent has labelled his government as one of the most corrupt, alleging financial irregularities in highway projects.

The Bharatiya Janata Party (BJP), India’s ruling party, has been the primary beneficiary of an opaque funding scheme since 2019, permitting individuals and companies to make unlimited and anonymous donations to political parties. This scheme has raised concerns about financial irregularities and corruption, particularly with the recent data leak that provided unprecedented insight into the inner workings of Indian politics.

According to Reuters, the BJP accounted for nearly half of the total bonds sold, amounting to 165 billion rupees ($1.98 billion), between January 2018 and February 2024. The Washington Post’s recent story revealed a tumultuous scenario in Indian politics, with substantial donations traced back to under-investigation firms revealing that Jalan’s enterprises covertly contributed millions to the Indian Prime Minister’s party. This data leak provided unprecedented insight into the inner workings of Indian politics, uncovering a clandestine funnelling of US$2 billion by Indian corporations to political entities since 2018.

These revelations sparked public outcry, particularly with national elections looming over the horizon, projected to be the world’s most expensive, surpassing even the anticipated costs of the 2024 U.S. presidential election.

Fascinatingly, the Supreme Court of India directed the central bank to reveal donor identities, and the Financial Action Task Force (FATF) is set to release its mutual evaluation report for India during the upcoming June 2024 plenary, right after the Indian elections. Beyond the bond controversy, India faces scrutiny from international bodies such as the UN, American Bar Association, and Amnesty International for human rights violations, weak control related to Money Laundering and Terrorist Financing. The evaluation will gauge how effectively India adheres to global standards in combating financial crimes, including money laundering and terrorist financing.

Therefore, it is critical for the world to ensure a peaceful order for economic prosperity and stable markets.

Pl, subscribe to the YouTube channel of republicpolicy.com