Pakistan’s economy stands out as an outlier in Asia, according to a new report that predicts the country will have the highest inflation rate but the fourth lowest economic growth rate among all 46 economies in the region.

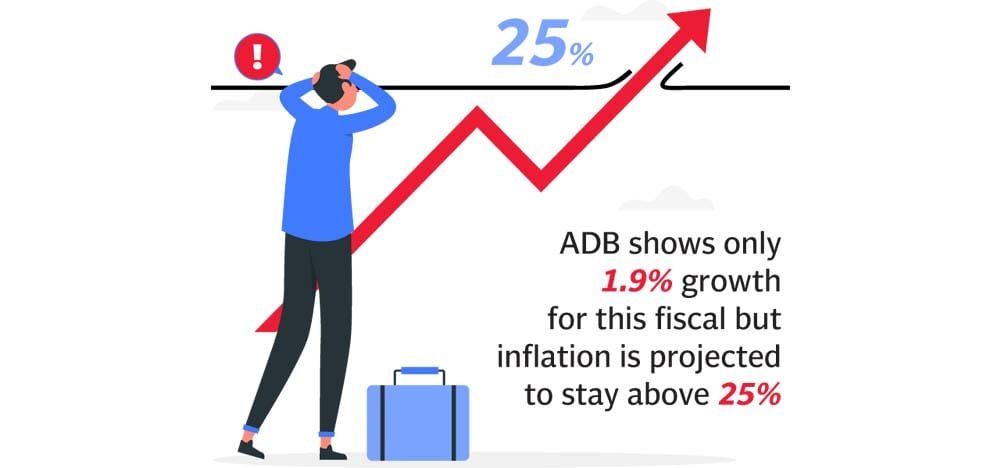

The Asia Development Outlook, the flagship publication of the Asian Development Bank (ADB), has slightly revised downward the economic growth forecast to 1.9%. Still, the inflation projection has significantly increased to 25% for the current fiscal year.

The report anticipates further increases in interest rates and calls for a fiscal consolidation plan that includes limited spending on defence and energy subsidies.

The report also points out that while the currencies of developing economies in Asia have marginally depreciated, Pakistan’s currency has seen a steep devaluation of 30%. Unlike other regional economies, Pakistan saw a decline in foreign remittances.

The ADB notes exceptionally high downside risks to Pakistan’s economic outlook.

Previously, Pakistan’s economic outlook was relatively poor only within the South Asia region, but continued deterioration in economic conditions has placed the country near the bottom of Asia.

The report projects that “for FY2024, inflation is forecast at 25%, sharply higher than the earlier 15% projection.” This inflation rate is far higher than the target range set by the central bank and much higher than the target. It represents the highest inflation rate in Asia, significantly exceeding the projected 10% for any other economy.

In the last fiscal year, inflation is estimated to have accelerated to 29.2% in FY2023, faster than the previously forecasted 27.5% in April, according to the ADB.

The report emphasises that regional currencies have depreciated marginally this year, 3.7% on a GDP-weighted average basis against the US dollar. However, Pakistan’s currency has experienced a significant 30% devaluation since January.

The ADB argues that administrative efforts to control the exchange rate led to a parallel foreign exchange market with a substantial premium over the official exchange rate. This, in turn, led to a further tightening of foreign currency liquidity in the interbank market, as it encouraged the use of the parallel market for inward remittances and proceeds from service exports. Consequently, recorded workers’ remittances fell by $4.3 billion to $27 billion in FY2023.

While net personal transfers increased by 13% in Nepal and 9% in Bangladesh from the same period in 2022, they have decreased by 17% in Pakistan.