Zafar Iqbal

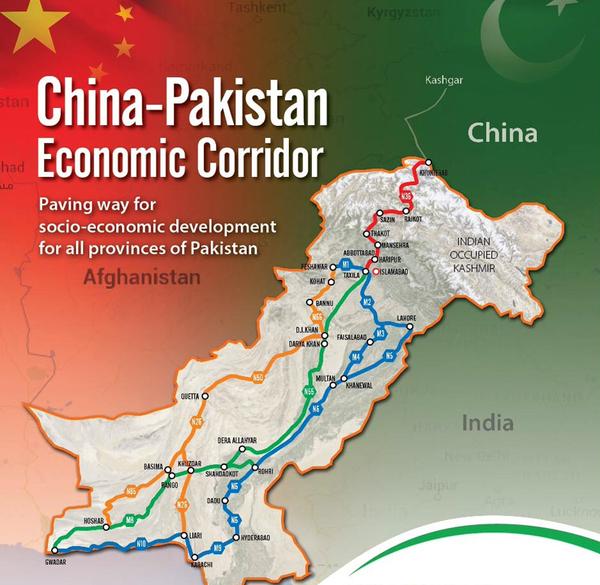

During a recent meeting of the National Assembly Standing Committee on Planning, Development, and Special Initiatives, the progress of the China-Pakistan Economic Corridor (CPEC) was reviewed. The meeting highlighted that 38 projects, valued at over USD 25 billion, have been completed, with another 23 projects, costing USD 2.1 billion, currently under development across various sectors under the CPEC framework.

The completed projects include 17 energy initiatives worth USD 18 billion, seven infrastructure projects, five related to Gwadar, and nine focused on socio-economic development. Funding for these projects was primarily provided by the EXIM Bank of China, with a repayment mechanism in place.

While it’s important to acknowledge the scale of these projects and the financial commitment involved, there’s growing concern among the public about the actual benefits these investments have brought to Pakistan’s economy and its people. The nation seeks transparency on how the hefty financial outlay has impacted economic growth, as well as whether these projects have delivered tangible returns or merely increased the country’s debt burden.

When Pakistan agreed to take on such large loans, it did so with the expectation that these projects would provide affordable energy, improve infrastructure, and drive economic growth. The goal was to build a more business-friendly environment that would fuel long-term economic prosperity. However, instead of reaping the anticipated benefits, the country has found itself caught in a debt trap, further constrained by the fiscal discipline imposed by the International Monetary Fund (IMF). This situation raises critical questions about the management of these loans, the selection of projects, and the overall economic strategy.

The primary issue stems from the ad-hoc and misguided economic priorities that have led to inefficient spending. This not only wasted valuable resources but also failed to generate the expected economic returns. To better understand the concerns, we must examine the feasibility and financial sustainability of the projects that received such large funding.

Starting with the energy sector, which received the bulk of the CPEC funding (USD 18 billion), the focus has been on building power plants, many of which rely on imported coal. Four coal-powered plants, with a combined capacity of 4,300 MW, were built at a cost of USD 6.2 billion. Additionally, USD 990 million was invested in Thar to generate 990 MW of power. However, this reliance on coal presents a significant challenge. Moving from fossil fuels to coal is not a sustainable or cost-effective solution, especially considering the global shift away from coal. At the COP29 climate summit in Baku, 25 countries pledged not to build any new unabated coal plants, a strong signal towards accelerating the phase-out of this highly polluting energy source.

On the other hand, the investment in renewable energy, such as solar and wind power, was also considerable—USD 1.4 billion was directed towards 400 MW of solar and 300 MW of wind power. Yet, the impact of this green energy on the national grid remains unclear. One potential success, however, could be the hydropower projects, with two plants generating 720 MW and 884 MW, costing USD 3.7 billion. Hydropower is generally considered a more sustainable energy source.

Another important project in the energy sector was the installation of a High Voltage Direct Current (HVDC) 660 KV transmission line at a cost of USD 1.7 billion. This is a strategic investment, with a long-term payback expected from electricity wheeling tariffs. However, this model has yet to be implemented effectively in Pakistan’s electricity regime, which raises concerns about the project’s long-term viability.

While these investments have increased Pakistan’s power generation capacity by approximately 7,500 MW, the country faces challenges in utilizing this capacity. Much of the additional generation is going unused due to high electricity tariffs and a lack of demand, meaning the investments have not translated into the economic growth that was promised.

Turning to infrastructure, investments such as the USD 1.6 billion Orange Line Metro system in Lahore, USD 2 billion in road networks, and USD 300 million in Gwadar’s free port and free zone are important long-term projects. However, Pakistan’s current economic struggles make it difficult to maintain these large-scale projects without significant financial support from the government. The Gwadar airport project, costing USD 230 million, and the road network development in Balochistan, valued at around USD 500 million, are similarly long-term ventures that will require ongoing financial commitment.

Another key element of CPEC is the development of Special Economic Zones (SEZs). Recently, Pakistan’s Federal Minister for Planning emphasized the need to expedite government-to-government (G2G) collaboration with China, particularly focusing on identifying land for proposed SEZs. While the concept of relocating Chinese industries to Pakistan holds potential, it remains in the early stages of planning, and there are doubts about how quickly this will translate into tangible economic benefits.

CPEC projects could have been a major driver of economic growth if the priorities and business models behind them were more strategically aligned with revenue generation and loan repayment capabilities. A sustainable business model would need to guarantee that these projects could generate sufficient revenue to repay loans while also contributing to profitability. Without this, these projects risk becoming unsustainable, leaving Pakistan with mounting debt and little economic benefit.

In conclusion, while CPEC projects hold potential for economic growth, their current implementation reveals significant gaps in planning and execution. The country’s economic managers must carefully assess the feasibility of each project, ensure that investments are strategically placed, and adopt models that will ensure both financial sustainability and long-term profitability. Only with the right focus and execution can the promise of CPEC projects be fully realized, benefiting both Pakistan’s economy and its people in a meaningful way.