Arshad Mahmood Awan

Benjamin Franklin’s famous quote, “In this world, nothing can be said to be certain except death and taxes,” resonates profoundly with the registered taxpayers of Pakistan, particularly the salaried class.

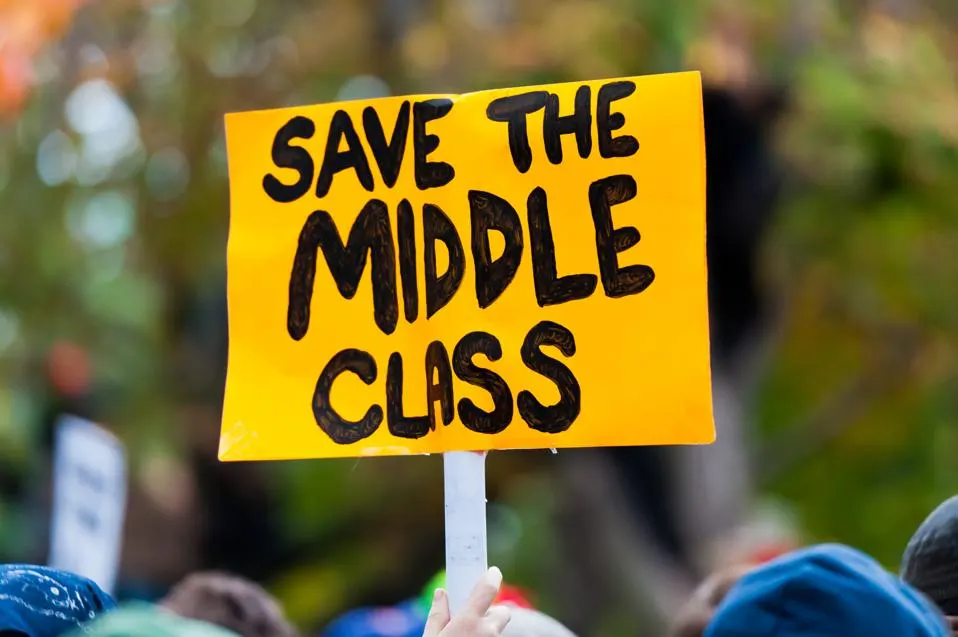

The salaried class in Pakistan, specifically those with annual incomes between 600,000 and 1.2 million rupees, is increasingly dissatisfied with the new tax policies introduced in the budget for the fiscal year 2024–25. Given the higher taxes they now have to pay, this group has been vocal about the need to adjust the exemption threshold.

While the government’s decision to raise the minimum wage from 32,000 to 37,000 rupees per month is commendable in light of inflation and rising living costs, it raises questions about equity. Individuals earning just 13,001 rupees above the new minimum wage are now required to pay a 5% tax on any income exceeding 50,000 rupees per month, which has highlighted the financial burden on the lower-middle class.

The Pakistani President recently emphasized the importance of a balanced approach to taxation that does not unduly burden the salaried class while ensuring adequate revenue generation for the state. His remarks align with a broader public sentiment, advocating for a reconsideration of existing tax laws to promote fairness and prevent undue impact on those approaching substantial tax obligations.

Pl watch the video and subscribe to the YouTube channel of republicpolicy.com

One cannot overlook the influence of the International Monetary Fund (IMF) on recent tax changes and related budgetary measures. Pakistan’s relations with the IMF have heavily influenced its taxation strategy as it strives to meet the stringent requirements of its IMF loans. These requirements often necessitate the government to enact more taxes and stricter tax policies to broaden the tax base, imposing a significant societal cost, particularly affecting the most vulnerable segments of society. The IMF’s conditions, while beneficial for stabilizing the economy and reducing budget deficits, can also lead to a heavier tax burden on the salaried class.

In light of President Asif Ali Zardari’s recent statements and actions, there is an urgent need to address tax issues. There’s a call for ensuring that tax collectors do not misuse power bills as a revenue-collection tool and reviewing the income tax structure and exemption levels. The tax changes proposed in Pakistan’s budget for 2024–25 have sparked significant debate and concern, especially regarding increased taxes on the salaried class and the incorporation of income tax into electricity bills, and the impact of IMF conditions.

To create a more equitable and sustainable fiscal policy, it is necessary to revise exemption levels, expand the tax base, and ensure transparent and fair revenue collection processes. In South Asia, countries like India, Bangladesh, and Sri Lanka have implemented various approaches to taxing the salaried class, often coupling tax obligations with specific benefits to alleviate the financial burden.

Higher taxes on the salaried class not only strain household finances but also contribute to a broader sense of economic insecurity, potentially leading to socio-economic instability and brain drain. Skilled professionals may seek better opportunities abroad, which can have significant and long-term negative effects on Pakistan’s economic growth and development. To mitigate these risks, it is crucial for the government to adopt a more progressive tax policy that reduces the burden on the salaried class and ensures a fairer distribution of tax obligations.